The realm of cryptocurrency is perpetually in motion, characterized by rapid innovations, shifting market dynamics, and a unique blend of technological advancement and speculative interest. Within this vibrant ecosystem, meme coins have carved out a distinctive niche, often driven by community sentiment, viral trends, and cultural relevance. Among these, Brett (Based) has emerged as a notable player, captivating the attention of investors and enthusiasts alike on the Base blockchain. As of 2025-06-09, Brett’s price stands at 0.04996173828840256 USD, prompting many to ponder its future trajectory. This article delves into a comprehensive price prediction for Brett, analyzing its historical performance, identifying key influencing factors, and leveraging a sophisticated forecasting algorithm to offer insights into its potential path over the coming months and years. Understanding the multifaceted forces that shape cryptocurrency valuations is crucial for anyone navigating this exciting yet volatile market.

Understanding Brett (Based) and Its Ecosystem

Brett is more than just another cryptocurrency; it’s a cultural phenomenon within the burgeoning Base blockchain ecosystem. Born from internet meme culture, specifically inspired by a character from Matt Furie’s “Boy’s Club” comic, Brett embodies the lighthearted and community-driven spirit often associated with successful meme coins. Unlike some meme coins that lack fundamental utility, Brett benefits from its position on the Base network, a layer-2 blockchain developed by Coinbase. This association provides Brett with a unique foundation, potentially linking it to a more established and reputable blockchain infrastructure.

The Base blockchain itself is designed to offer a secure, low-cost, developer-friendly environment for building decentralized applications. Its connection to Coinbase, one of the largest cryptocurrency exchanges globally, lends it a significant advantage in terms of potential user adoption and liquidity. For Brett, being a prominent meme coin on Base means it could ride the coattails of the network’s growth and increasing developer activity. As more users and applications migrate to Base, the visibility and liquidity of tokens like Brett could naturally increase. Its appeal lies in its simplicity, its strong community focus, and its potential to become the “blue chip” meme coin of the Base ecosystem, much like Dogecoin or Shiba Inu on other networks. This combination of cultural resonance and a robust underlying blockchain infrastructure sets Brett apart from many other meme coins that often rely solely on ephemeral hype.

A Look Back: Brett’s Historical Price Performance (Last 12 Months)

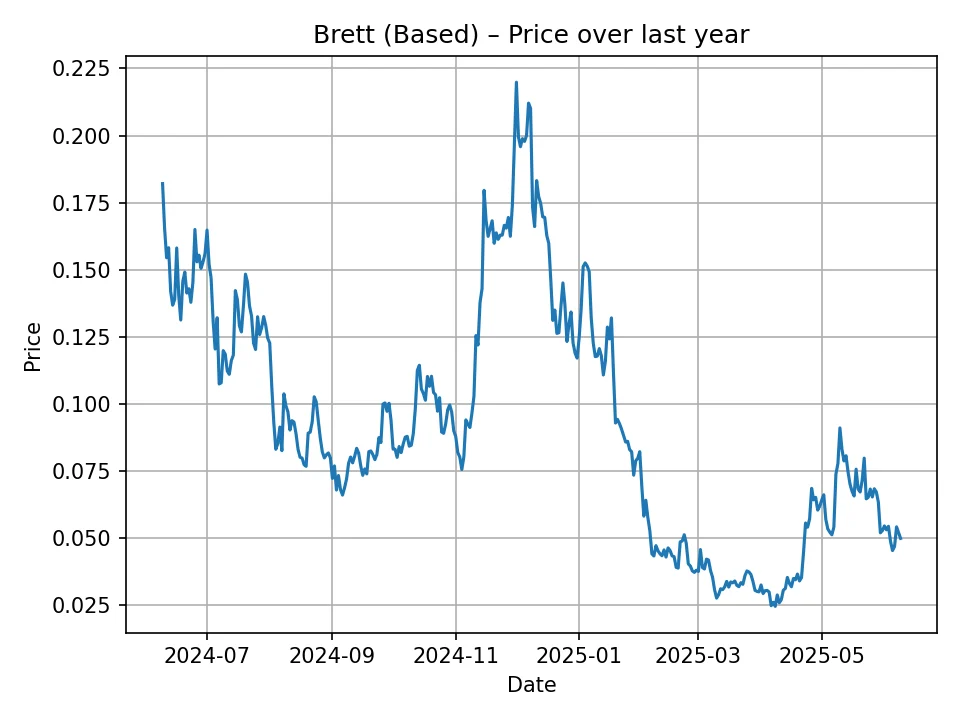

Analyzing the historical price data of Brett (Based) provides crucial context for its current valuation and potential future movements. Over the past 12 months, Brett has experienced significant volatility, characteristic of many cryptocurrencies, especially those in the meme coin category. The provided historical data reveals a journey marked by peaks and troughs, reflecting both market-wide trends and asset-specific developments.

Starting from its higher points earlier in its 12-month history, such as values around $0.182, $0.165, and even touching $0.219 at one point, Brett demonstrated considerable upside potential. These periods of elevated prices likely coincided with broader bullish trends in the crypto market or specific hype cycles surrounding the Base blockchain and its ecosystem. During these times, early adopters and those who recognized its potential as a leading meme coin on Base might have seen substantial gains. The highest recorded price in the provided data, 0.21987700462341309 USD, indicates a period of strong positive momentum and investor confidence.

However, the trajectory has not been linear. Following these highs, Brett’s price began a gradual descent, marked by intermittent rallies and drops. We can observe several phases:

* Early Volatility (Higher Ranges): The initial months show prices frequently fluctuating between $0.13 and $0.18, with occasional spikes above $0.20. This suggests a period of discovery and speculation as the coin gained traction.

* Mid-Range Consolidation: As the year progressed, Brett seemed to find a consolidation range, often trading between $0.07 and $0.12. This indicates a potential stabilization of interest, where early hype might have settled, and the market was re-evaluating its fair value.

* Downward Trend and Current Levels: More recently, the data shows a distinct downward trend, with prices falling below $0.07 and eventually reaching the current level of approximately $0.049. This significant decline from its all-time highs could be attributed to several factors: a broader market correction, decreased enthusiasm for meme coins, or potentially profit-taking by early investors. The drop to values as low as $0.024 before a slight recovery to its current price suggests a period of substantial bearish pressure.

The current price of approximately $0.0499 represents a considerable pullback from its historical peaks. This can be viewed in two ways: as a reflection of waning interest or as a potential entry point for new investors who believe in its long-term viability. The recent data points show a struggle to maintain momentum above $0.05, with brief pushes higher often met with selling pressure. However, it’s crucial to remember that meme coins are particularly susceptible to rapid shifts in sentiment. A strong community push, a viral moment, or significant developments on the Base chain could quickly alter this trend. Understanding this historical context is vital before projecting future price movements, as past performance, while not indicative of future results, often reveals inherent patterns and sensitivities of the asset.

Key Factors Influencing Brett’s Price Trajectory

The price of any cryptocurrency, especially a meme coin like Brett, is a complex interplay of numerous factors. Predicting its future requires considering these variables beyond mere historical data.

1. General Cryptocurrency Market Sentiment

The broader cryptocurrency market acts as a significant tide that lifts or lowers most individual assets. Bitcoin (BTC) and Ethereum (ETH) often dictate the overall market direction. A bullish Bitcoin rally can create a positive ripple effect, driving up altcoin prices, including meme coins. Conversely, a Bitcoin correction or bear market typically drags down the entire market. News regarding inflation, interest rates, global economic stability, and regulatory developments all contribute to this overarching sentiment. For Brett, sustained growth would likely require a healthy and optimistic crypto market environment.

2. Base Blockchain Ecosystem Growth

Brett’s native home is the Base blockchain. The success and adoption of Base are intrinsically linked to Brett’s potential. As Coinbase continues to promote and develop Base, attracting more developers, users, and decentralized applications (dApps), the overall liquidity and utility within the ecosystem will grow. This expansion could directly benefit Brett by increasing its visibility, trading volume, and perceived value as a leading asset on a thriving chain. New integrations, partnerships, or significant dApp launches on Base could act as catalysts for Brett’s price.

3. Community Strength and Engagement

Meme coins are inherently community-driven. Their value often stems from the collective belief, participation, and enthusiasm of their holders. A strong, active, and vocal community on platforms like X (formerly Twitter), Telegram, and Discord can generate hype, coordinate marketing efforts, and attract new investors. Sustained community engagement, creation of memes, and organic viral spread are critical for maintaining Brett’s relevance and appeal. Any decline in community interest or fragmentation could pose a significant risk.

4. Utility and Development (or Lack Thereof)

While Brett is primarily a meme coin, any future development or integration of utility could significantly impact its long-term viability. This could include, for example, its use in decentralized finance (DeFi) protocols on Base, as a governance token, or integration into gaming or NFT projects. Even if its primary identity remains meme-driven, adding layers of utility could attract a different segment of investors seeking more fundamental value, thereby broadening its appeal beyond pure speculation. Currently, its utility is minimal, which means its price is more susceptible to speculative whims.

5. Social Media Trends and Viral Potential

The virality of a meme coin is its lifeblood. A sudden surge in social media mentions, endorsements from prominent figures, or a new meme wave can trigger exponential price pumps. This aspect is highly unpredictable but incredibly potent. For Brett to achieve new highs, it would likely need to tap into a new wave of internet culture or become central to a broader meme-driven narrative.

6. Liquidity and Exchange Listings

Increased liquidity makes it easier for investors to buy and sell Brett, reducing price slippage and attracting larger traders. Listings on more centralized exchanges (CEXs) beyond its initial launch platforms can significantly boost its accessibility to a wider audience, driving demand and trading volume. Conversely, delistings or limited trading pairs could hinder its growth.

7. Competition Within the Meme Coin Space

The meme coin sector is highly competitive, with new tokens constantly emerging. Brett must maintain its unique identity and appeal to stand out. The rise of new, more viral meme coins on Base or other networks could divert attention and capital away from Brett, posing a constant challenge to its market share and price appreciation.

These factors, both internal to Brett and external within the broader crypto and economic landscape, will collectively determine its price trajectory in the coming months and years.

Introducing NovaCast: An Algorithmic Approach to Price Prediction

In the highly complex and often unpredictable world of cryptocurrency, relying solely on historical charts and fundamental analysis can be insufficient. Market sentiment, technological advancements, and macroeconomic shifts all play a role, making accurate forecasting a formidable challenge. This is where advanced predictive algorithms, such as NovaCast, come into play.

NovaCast is a proprietary forecasting algorithm designed to navigate the intricacies of digital asset markets. While the precise mechanics of such an algorithm remain proprietary, its core strength lies in its ability to process vast amounts of historical data—including price, volume, and potentially other market indicators—to identify patterns and project future price movements. It goes beyond simple linear extrapolations, employing sophisticated statistical models, machine learning techniques, and potentially incorporating elements of sentiment analysis or network growth metrics.

The methodology behind NovaCast aims to minimize human bias and capitalize on data-driven insights. By analyzing historical price fluctuations, trends, and correlations, the algorithm attempts to understand the underlying dynamics that have historically influenced Brett’s value. It can account for volatility, identify support and resistance levels, and potentially predict periods of consolidation or breakout, based on learned patterns from past market behavior. The goal is to provide a probabilistic outlook, offering investors a more informed perspective on potential future price ranges, rather than definitive guarantees. It’s important to remember that even the most advanced algorithms operate on probabilities and historical data, and the crypto market can always be swayed by unforeseen events. However, tools like NovaCast offer a structured, analytical framework for approaching price predictions in a volatile asset class.

Brett (Based) Monthly Price Forecast (Next 12 Months) by NovaCast

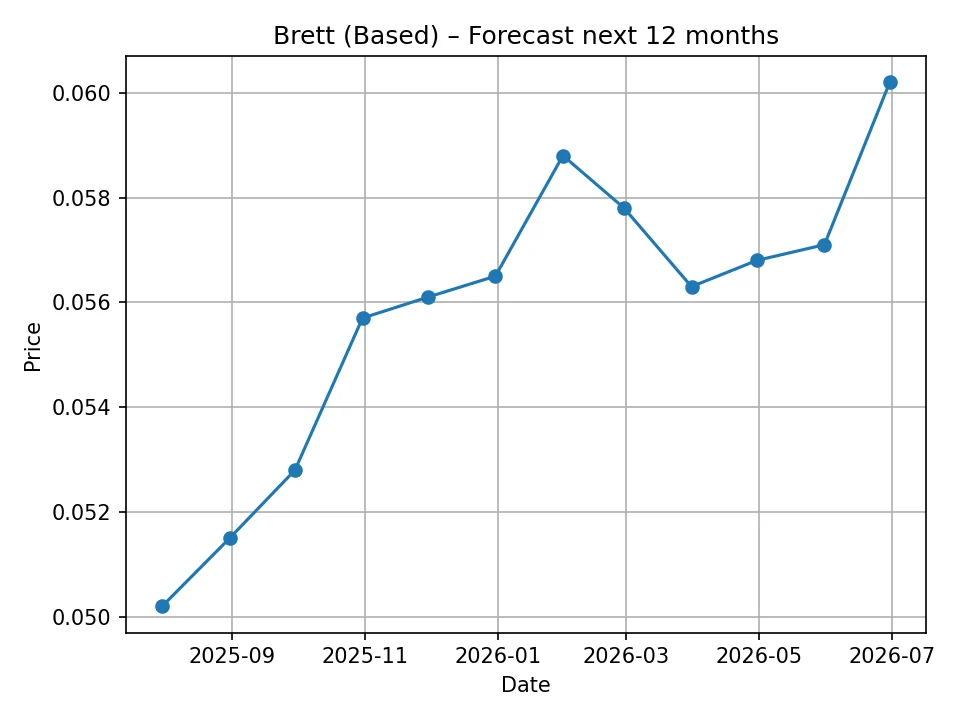

Based on the analysis conducted by the NovaCast algorithm, the monthly price forecast for Brett (Based) over the next 12 months, from July 2025 to June 2026, presents a picture of gradual, albeit modest, growth. This projection suggests a period of potential stabilization and slight appreciation, moving away from its recent lows.

Here is the detailed monthly forecast:

| Month | Predicted Price (USD) |

|---|---|

| 2025-07 | 0.0502 |

| 2025-08 | 0.0515 |

| 2025-09 | 0.0528 |

| 2025-10 | 0.0557 |

| 2025-11 | 0.0561 |

| 2025-12 | 0.0565 |

| 2026-01 | 0.0588 |

| 2026-02 | 0.0578 |

| 2026-03 | 0.0563 |

| 2026-04 | 0.0568 |

| 2026-05 | 0.0571 |

| 2026-06 | 0.0602 |

Interpretation of the Monthly Forecast:

The NovaCast algorithm predicts a consistent, albeit slow, upward trend for Brett over the next year. Starting from a projected $0.0502 in July 2025, just slightly above its current price, the forecast suggests that Brett could reach $0.0602 by June 2026. This represents approximately a 20% increase from its current level over the next year.

Several observations can be drawn from this short-term outlook:

* Steady Recovery: The forecast does not indicate any dramatic spikes or crashes but rather a sustained, modest recovery. This suggests that the algorithm anticipates a period of consolidation and gradual accumulation, perhaps driven by underlying stability in the broader market or slow but steady growth of the Base ecosystem.

* Building a New Base: After significant retracements from its highs, this forecast suggests Brett might be establishing a new, higher floor for its price. The increments are small, typically a fraction of a cent each month, indicating that significant speculative pumps are not expected in the immediate future, but rather a more organic, sentiment-driven rise.

* Potential for Momentum: While the growth is modest, any consistent upward movement can build positive sentiment and attract more investors. If the Base blockchain gains more traction or if there’s a resurgence of interest in meme coins, these steady gains could accelerate beyond the algorithm’s baseline predictions.

* Sensitivity to External Factors: It’s crucial to remember that meme coins like Brett are highly susceptible to sudden shifts in market sentiment or viral trends. The NovaCast algorithm provides a data-driven baseline, but unforeseen events—positive or negative—could cause deviations. A major development on the Base chain, a significant partnership, or a widespread crypto bull run could propel Brett past these monthly targets, while a market downturn could cause a retest of lower levels.

In essence, the monthly forecast points towards a conservative but positive outlook, suggesting that Brett could slowly but surely recover some of its lost ground and build a stronger foundation for future growth. Investors looking at the short-to-medium term might find this forecast encouraging, indicating a potential for moderate returns if the market conditions align.

Brett (Based) Yearly Price Forecast (Next 10 Years) by NovaCast

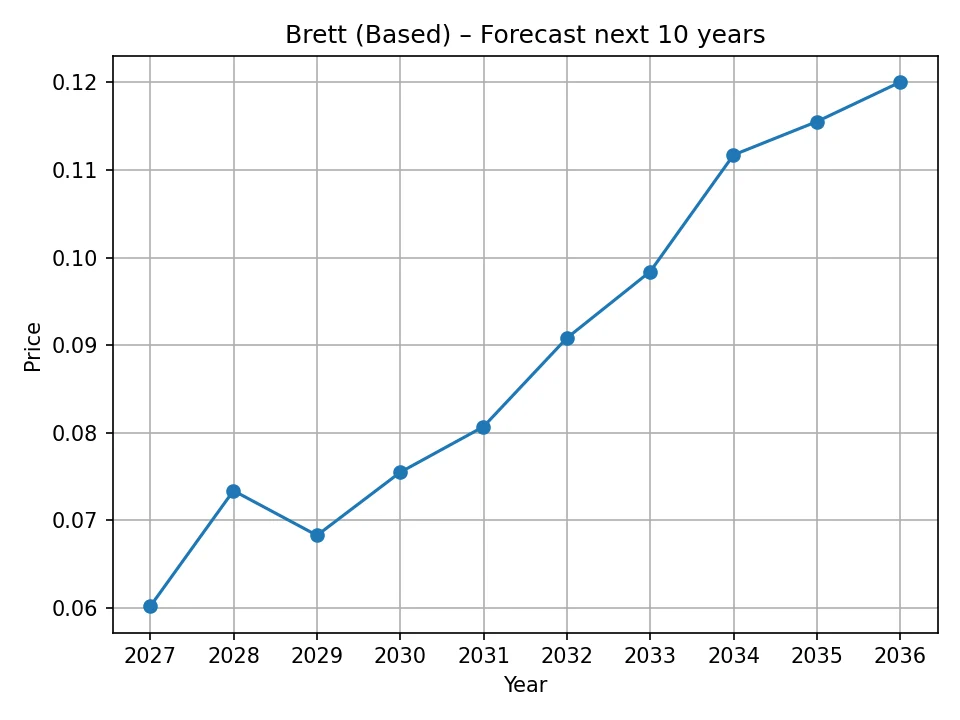

Extending the horizon, the NovaCast algorithm provides a fascinating long-term outlook for Brett (Based) over the next decade, from 2026 through 2035. This yearly forecast offers a glimpse into the potential trajectory of the meme coin, reflecting the algorithm’s assessment of its sustained relevance and growth within the cryptocurrency landscape.

Here is the detailed yearly forecast:

| Year | Predicted Price (USD) |

|---|---|

| 2026 | 0.0602 |

| 2027 | 0.0734 |

| 2028 | 0.0683 |

| 2029 | 0.0755 |

| 2030 | 0.0807 |

| 2031 | 0.0908 |

| 2032 | 0.0984 |

| 2033 | 0.1117 |

| 2034 | 0.1155 |

| 2035 | 0.12 |

Interpretation of the Yearly Forecast:

The NovaCast algorithm’s long-term prediction for Brett suggests a consistent, albeit gradual, upward trend over the next decade. Starting from $0.0602 in 2026 (the end point of the monthly forecast), the algorithm projects Brett to reach $0.12 by 2035. This indicates a potential doubling of its price from the 2026 forecast and a more significant appreciation from its current levels over a 10-year span.

Key insights from this long-term perspective include:

* Sustained Growth Potential: The forecast consistently shows an increase in Brett’s price year-over-year, with a slight dip in 2028, but otherwise a steady climb. This implies that the algorithm identifies underlying factors that could contribute to its long-term appreciation. This could be due to the continued growth of the Base blockchain, the enduring nature of meme coin culture, or Brett solidifying its position as a prominent asset within its niche.

* Patience is Key: The projected gains are not explosive year-on-year. For example, moving from $0.0602 in 2026 to $0.12 in 2035 signifies an average annual growth rate that is steady rather than parabolic. This suggests that long-term holders might see modest but reliable returns if the forecast holds true. It underscores the idea that for assets like Brett, significant appreciation might require considerable patience and the maturation of the underlying ecosystem.

* Return to Previous Highs?: While the forecast shows positive growth, it does not predict Brett returning to its all-time highs of $0.20+ within this 10-year period. The highest predicted price is $0.12 in 2035. This could imply that the algorithm factors in the inherent volatility and speculative nature of meme coins, suggesting that while they can maintain relevance and grow, achieving prior peak valuations might be challenging without extraordinary external catalysts or a significant shift in utility.

* Long-Term Relevance of Base Blockchain: The continued increase in Brett’s value implicitly relies on the long-term success and widespread adoption of the Base blockchain. If Base falters or fails to attract significant users and developers, Brett’s foundation for growth could be undermined. Conversely, if Base thrives and becomes a leading L2 solution, Brett could well exceed these predictions.

* The 2028 Dip: The minor dip predicted for 2028 (from $0.0734 in 2027 to $0.0683) could represent a cyclical downturn, a period of consolidation, or perhaps a projected bear market phase within the broader crypto cycle. Such fluctuations are natural in long-term forecasts for volatile assets.

In summary, the NovaCast algorithm projects a relatively stable and positively trending future for Brett (Based) over the next decade. It suggests that while the path may not be marked by explosive, rapid gains, the asset holds potential for consistent appreciation for long-term investors who believe in the longevity of the Base ecosystem and the meme coin phenomenon.

Risks and Opportunities in Brett (Based) Investment

Investing in cryptocurrencies, particularly meme coins, inherently comes with a unique set of risks and opportunities. Brett (Based) is no exception, and potential investors must carefully weigh these factors.

Risks:

- Extreme Volatility and Speculative Nature: Meme coins are notoriously volatile. Their value is largely driven by sentiment, social media trends, and hype, rather than inherent utility or fundamental metrics. This means prices can swing wildly, leading to rapid gains but also significant losses. The historical data for Brett clearly demonstrates this, with sharp declines from its highs.

- Dependence on Trends and Community Hype: The longevity of a meme coin often hinges on its ability to stay relevant in internet culture and maintain an active community. If interest wanes, or a new, more viral meme coin emerges, Brett could quickly lose its appeal and value. This dependence on fleeting trends makes it a high-risk asset.

- Lack of Intrinsic Utility: While Brett resides on the technologically robust Base blockchain, its primary function remains that of a meme coin. Unlike utility tokens or stablecoins, it generally lacks concrete use cases within decentralized applications, enterprise solutions, or payment systems. This absence of fundamental utility makes its valuation highly speculative.

- Competition: The meme coin market is saturated. Thousands of new meme coins are launched regularly, all vying for attention and capital. Brett faces stiff competition from established meme coins on other chains and new contenders emerging on Base itself.

- Smart Contract Risks: Like all cryptocurrencies built on smart contracts, Brett is susceptible to potential vulnerabilities or bugs in its underlying code. While no major issues have been reported, smart contract exploits remain a risk in the decentralized space.

- Broader Market Downturns: Even if Brett maintains its community and relevance, a significant bear market in the overall crypto space, driven by macroeconomic factors or regulatory crackdowns, would likely drag its price down regardless of its individual strengths.

Opportunities:

- First-Mover Advantage on Base: Brett has established itself as one of the prominent meme coins on the Base blockchain. As Base gains more traction and adoption, Brett could benefit from being an early and recognizable asset within this growing ecosystem.

- Strong Community Potential: If Brett’s community remains vibrant and engaged, it has the potential to drive organic growth through grassroots marketing, social media campaigns, and creative content creation. This community-driven spirit is a powerful force unique to meme coins.

- Low Price, High Upside Potential (from current levels): For investors with a high-risk tolerance, Brett’s current relatively low price might be seen as an attractive entry point, offering significant upside if it manages to regain previous highs or establish new ones. A small investment could yield substantial returns if the coin experiences another viral surge.

- Leveraging the Base Ecosystem Growth: As the Base blockchain attracts more users, developers, and liquidity, Brett could indirectly benefit. Increased activity on Base means more eyes on its leading tokens, including Brett, potentially leading to increased demand and trading volume.

- Potential for Future Utility (though speculative): While currently lacking significant utility, the crypto space is dynamic. There’s always a speculative possibility that Brett could integrate with future DeFi protocols, gaming, or NFT projects on Base, which could provide it with a more fundamental value proposition.

- Viral Marketing Moments: Meme coins thrive on virality. A well-timed social media trend, endorsement from a prominent figure, or integration into a viral internet phenomenon could trigger explosive price appreciation, creating significant opportunities for early or nimble investors.

Ultimately, investing in Brett (Based) is a high-risk, high-reward proposition. While there are clear opportunities for growth driven by its community and its position on the Base blockchain, the inherent speculative nature and dependence on fleeting trends necessitate a cautious and informed approach.

Conclusion

Brett (Based) stands as a testament to the dynamic and often unpredictable nature of the cryptocurrency market, particularly within the meme coin sector. Its journey over the past year, marked by significant price swings and a recent retracement, highlights the inherent volatility and speculative interest that define such assets. Positioned on the rapidly evolving Base blockchain, Brett’s future remains intricately tied to both the broader crypto market’s sentiment and the specific growth trajectory of its native network.

The historical analysis reveals a coin that has demonstrated considerable upside potential, reaching notable highs before settling into its current range. This journey underscores the importance of community engagement and viral trends in driving meme coin valuations. Looking ahead, the price forecasts generated by the NovaCast algorithm offer a structured, data-driven perspective on Brett’s potential path. The short-term monthly forecast suggests a period of gradual recovery and stabilization, indicating a modest but consistent upward trend towards $0.0602 by June 2026. This implies a potential for steady accumulation and building a new foundation from its current price point.

Extending this outlook, the long-term yearly forecast projects continued appreciation for Brett over the next decade, with the algorithm predicting a value of $0.12 by 2035. While this growth is shown to be consistent, it also suggests a more tempered progression compared to its past explosive highs, implying that sustained relevance and ecosystem growth will be key drivers rather than singular viral pumps. This long-term perspective signals potential for patient investors who believe in the enduring appeal of Brett and the continued expansion of the Base ecosystem.

However, it is crucial for every potential investor to recognize that these forecasts are based on an algorithmic interpretation of historical data and current market conditions. The world of meme coins is highly sensitive to sentiment, competition, and unforeseen developments. The inherent lack of substantial utility, coupled with the high volatility characteristic of meme assets, means that risks are significant. While opportunities exist for those willing to embrace the speculative nature of Brett, including its first-mover advantage on Base and the power of its community, a comprehensive understanding of both the potential rewards and the substantial risks is paramount. Diligent research, careful consideration of personal financial goals, and a cautious approach are always advisable in the ever-evolving landscape of cryptocurrency investments.

Disclaimer: The price predictions and information provided in this article are for informational purposes only and do not constitute financial advice. Cryptocurrency markets are highly volatile and speculative. The forecasts presented here are generated using a proprietary NovaCast algorithm, which analyzes historical data and market trends, but past performance is not indicative of future results. We are not responsible for any investment decisions made based on the information provided herein. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Chris brings over six years of hands-on experience in cryptocurrency, bitcoin, business, and finance journalism. He’s known for clear, accurate reporting and insightful analysis that helps readers stay informed in fast-moving markets. When he’s off the clock, Chris enjoys researching emerging blockchain projects and mentoring new writers.