The burgeoning decentralized finance (DeFi) sector continues to revolutionize traditional financial paradigms, offering innovative solutions for lending, borrowing, and asset management without intermediaries. Among the protocols leading this charge, Morpho stands out for its unique approach to optimizing capital efficiency within established lending markets. As of June 9, 2025, investors and enthusiasts are keenly observing Morpho’s trajectory, seeking to understand its potential value and future price movements in an ever-evolving digital asset landscape. This comprehensive analysis delves into Morpho’s core functionalities, examines its historical performance, explores the myriad factors influencing its price, and provides detailed price predictions based on advanced algorithmic models.

Morpho aims to enhance the efficiency of existing lending protocols like Aave and Compound by introducing a peer-to-peer (P2P) matching engine. Instead of routing all liquidity through a pooled model, Morpho intelligently matches lenders and borrowers directly when possible, thereby enabling more competitive interest rates. When direct matching isn’t feasible, it seamlessly falls back to the underlying pooled liquidity protocol. This hybrid model offers users the best of both worlds: optimized rates through P2P connections and the robust liquidity guarantees of large, established pools. The subsequent evolution of Morpho with Morpho Blue further refines this approach, introducing a highly modular and immutable lending primitive that prioritizes simplicity, capital efficiency, and permissionless operation for isolated lending markets. This design philosophy positions Morpho not just as an optimizer for existing protocols, but as a foundational layer for novel lending applications.

Understanding Morpho: Technology and Core Value Proposition

At its heart, Morpho’s innovation lies in its ability to abstract away complexity while delivering superior economic outcomes for its users. The Morpho protocol operates on top of popular DeFi lending platforms, acting as an overlay that intelligently routes capital. For lenders, this often translates to higher yields, and for borrowers, lower interest rates, compared to directly interacting with the underlying protocols. This arbitrage opportunity is a significant driver of adoption and liquidity within the Morpho ecosystem.

The introduction of Morpho Blue marked a pivotal moment in the protocol’s development. Unlike its predecessors (Morpho-Aave and Morpho-Compound optimizers), Morpho Blue is a standalone, immutable lending primitive. It allows anyone to create lending markets with specific collateral and loan assets, and defined Loan-to-Value (LTV) ratios. This modularity opens up a vast array of possibilities, enabling specialized markets and increasing overall capital efficiency across the DeFi landscape. This architectural shift significantly enhances Morpho’s long-term viability and its potential to become a fundamental building block for new financial products within the decentralized economy.

Key features that underpin Morpho’s value include:

- Optimized Rates: By enabling direct P2P matching, Morpho can offer rates that are often superior to traditional pooled lending.

- Capital Efficiency: Reducing spread between borrowing and lending rates means capital is used more effectively, attracting more participants.

- Security through Abstraction: Morpho inherits the security of the underlying audited protocols (like Aave and Compound), adding an additional layer of scrutiny for its own smart contracts. Morpho Blue’s immutability further solidifies its security posture.

- Composability: As a fundamental building block, Morpho Blue is designed to be easily integrated into other DeFi applications, fostering innovation and expanding its reach.

- Decentralized Governance: The MORPHO token grants holders governance rights, allowing the community to steer the protocol’s future development and parameters.

These technological advantages and strategic positioning within the DeFi ecosystem are critical considerations when evaluating Morpho’s future price potential. Its ability to attract and retain users through better rates and flexible market creation is directly correlated with its long-term success and token valuation.

Historical Price Performance of Morpho (Last 12 Months)

Analyzing historical price data provides crucial context for understanding Morpho’s past market behavior and can offer insights into its potential future trends. The provided daily historical data for Morpho over the last 12 months reveals a dynamic price trajectory, characterized by significant fluctuations. Examining this data helps identify periods of growth, consolidation, and decline, which often reflect broader market sentiment, protocol developments, or macroeconomic shifts.

The price points show considerable volatility, ranging from lows around $0.85 to highs approaching $3.92. Initially, the price hovered between $1.50 – $2.50, occasionally spiking above $3.00. There was a notable surge in late 2024 / early 2025, with prices reaching peaks around $3.68 – $3.92, suggesting strong market interest or significant positive developments during that period. This was followed by a correction, bringing the price back down, at times below $1.00 before stabilizing more recently around the $1.30 – $1.70 range.

Such fluctuations are common in the cryptocurrency market, especially for newer or evolving protocols. Factors that could have influenced these movements include: overall crypto market bull/bear cycles, major upgrades or announcements related to Morpho Blue or new integrations, liquidity incentives, changes in Total Value Locked (TVL) on the platform, and prevailing sentiment towards DeFi lending as a whole. Periods of significant price increase could be attributed to increased adoption, successful governance proposals, or favorable market conditions that drive demand for capital-efficient lending solutions. Conversely, declines might reflect broader market corrections, profit-taking, or increased competition.

Understanding this historical context is vital, as it highlights Morpho’s sensitivity to market dynamics and its capacity for both rapid growth and pullbacks. While past performance is not indicative of future results, it helps in gauging the asset’s typical volatility and its response to various market stimuli.

Factors Influencing Morpho’s Price

Predicting the future price of any cryptocurrency, including Morpho, involves analyzing a complex interplay of internal and external factors. These influences can cause significant price swings and determine long-term value appreciation or depreciation. For Morpho, a DeFi protocol focused on lending optimization, specific drivers are particularly impactful.

1. Overall Cryptocurrency Market Sentiment

The broader cryptocurrency market, often led by Bitcoin (BTC) and Ethereum (ETH), significantly influences altcoin prices. A bullish BTC market tends to lift most altcoins, including Morpho, as investor confidence and capital flow into the digital asset space increase. Conversely, a bearish trend can pull down even fundamentally strong projects. Macroeconomic conditions, such as inflation rates, interest rate decisions by central banks, and global economic stability, also contribute to overall market sentiment and risk appetite for volatile assets like cryptocurrencies.

2. Decentralized Finance (DeFi) Sector Growth and Adoption

As a core DeFi protocol, Morpho’s success is intrinsically linked to the growth and adoption of the DeFi sector. Increased Total Value Locked (TVL) across DeFi, higher user engagement, and expansion into new use cases or blockchains can positively impact Morpho. Conversely, security exploits, regulatory crackdowns, or a decline in interest in DeFi could hinder its growth.

3. Protocol Developments and Upgrades

Continuous innovation and successful implementation of new features are crucial for any blockchain project. For Morpho, this includes upgrades to its core P2P matching engine, new integrations with other protocols, expansion of Morpho Blue’s capabilities (e.g., support for more assets, or novel market types), and improvements in user experience. Significant technical milestones or partnerships can act as catalysts for price appreciation. Any delays, bugs, or security vulnerabilities, however, could lead to negative price reactions.

4. Total Value Locked (TVL) and User Metrics

For lending protocols, TVL is a key metric indicating liquidity and user trust. A consistent increase in Morpho’s TVL signifies growing adoption by lenders and borrowers, which directly translates to higher demand for the protocol’s services and potentially for its native token. Other metrics like the number of unique users, transaction volume, and borrowing/lending activity also provide insights into the protocol’s health and utility.

5. Tokenomics and Governance (MORPHO Token)

The utility and design of the MORPHO token play a vital role. If the token offers strong incentives for participation, governance rights, or staking rewards, it can create demand. The emission schedule, vesting periods, and potential deflationary mechanisms (e.g., token burns if implemented) can also impact supply dynamics and price. Active and engaged governance, where token holders make sound decisions for the protocol’s future, fosters confidence.

6. Competition

The DeFi lending landscape is highly competitive, with established players like Aave and Compound, as well as emerging protocols. Morpho’s ability to maintain its competitive edge through superior rates, innovative features (like Morpho Blue’s modularity), and strong security will be crucial for sustained growth. Losing market share to competitors could negatively impact its price.

7. Regulatory Environment

Uncertainty surrounding cryptocurrency regulations worldwide poses a significant risk. Clear and favorable regulations could foster broader adoption and institutional investment, while restrictive or ambiguous rules could deter participation and stifle innovation in the DeFi space, directly affecting Morpho.

8. Security and Audits

Smart contract exploits and security breaches are major concerns in DeFi. Morpho’s reliance on audited smart contracts and its focus on security are paramount. Any real or perceived security vulnerability could lead to a loss of trust, capital flight, and a sharp decline in token price. Regular audits and a robust bug bounty program are essential for maintaining user confidence.

Considering these diverse factors, Morpho’s future price trajectory will likely be a reflection of its continued technological advancement, its ability to attract and retain liquidity, and the broader market conditions affecting the cryptocurrency and DeFi sectors.

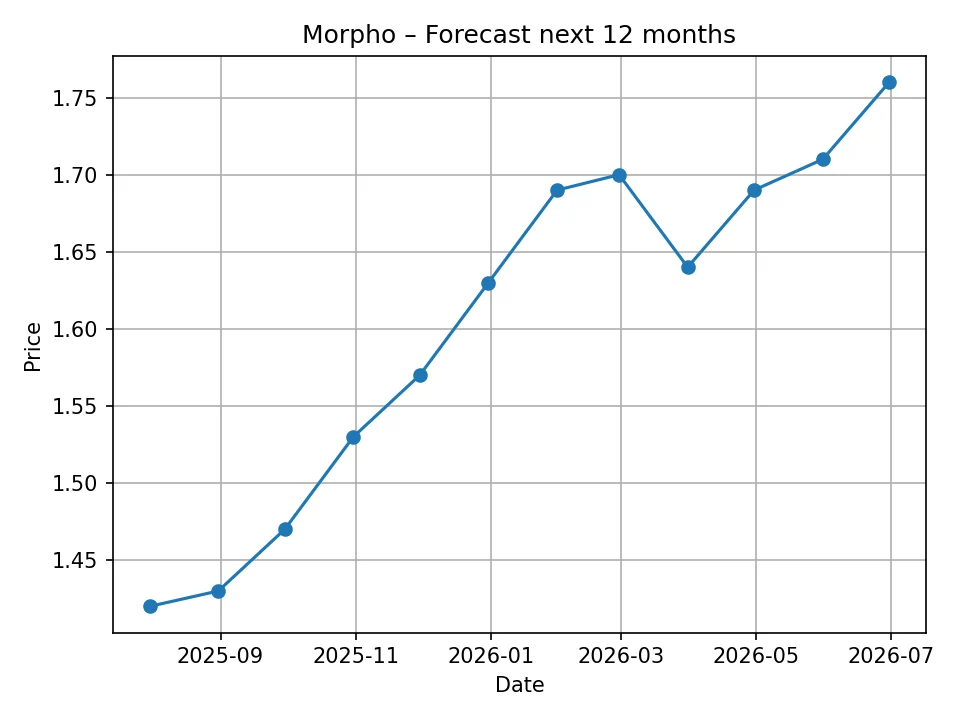

Morpho Price Forecast: Short-Term Outlook (12 Months)

The short-term price trajectory of Morpho is subject to immediate market reactions, news, and the ongoing adoption of its latest innovations like Morpho Blue. According to the EchoPredict algorithm, Morpho is projected to experience a gradual but steady upward trend over the next 12 months.

Below is the detailed monthly forecast for Morpho, from July 2025 to June 2026:

| Month | Projected Price (USD) |

|---|---|

| July 2025 | $1.42 |

| August 2025 | $1.43 |

| September 2025 | $1.47 |

| October 2025 | $1.53 |

| November 2025 | $1.57 |

| December 2025 | $1.63 |

| January 2026 | $1.69 |

| February 2026 | $1.70 |

| March 2026 | $1.64 |

| April 2026 | $1.69 |

| May 2026 | $1.71 |

| June 2026 | $1.76 |

The forecast suggests a cautious but consistent positive movement. Starting at $1.42 in July 2025, the price is anticipated to reach approximately $1.76 by June 2026. This modest growth implies that the algorithm expects Morpho to either consolidate its recent gains, or that it anticipates a period of steady accumulation driven by underlying fundamental strength rather than speculative surges. The slight dip predicted for March 2026 ($1.64) before resuming an upward trajectory could indicate minor market corrections or temporary shifts in sentiment.

Several factors could contribute to this short-term performance. If Morpho successfully continues to attract liquidity to its Morpho Blue markets and demonstrates increased capital efficiency, this could steadily drive demand for the MORPHO token. Furthermore, positive developments in the broader DeFi ecosystem, such as increased institutional adoption of decentralized lending solutions or favorable regulatory clarity, could provide tailwinds. Conversely, any major smart contract exploits in the DeFi space, unexpected regulatory hurdles, or a significant downturn in the overall crypto market could challenge this positive outlook, leading to potential deviations from the predicted path.

The short-term outlook emphasizes the importance of monitoring on-chain metrics, such as TVL and transaction volume on Morpho Blue, as well as significant governance proposals that could affect the protocol’s growth and profitability. The consistent, albeit moderate, projected increase suggests a belief in Morpho’s fundamental utility and its ability to capture a growing share of the DeFi lending market.

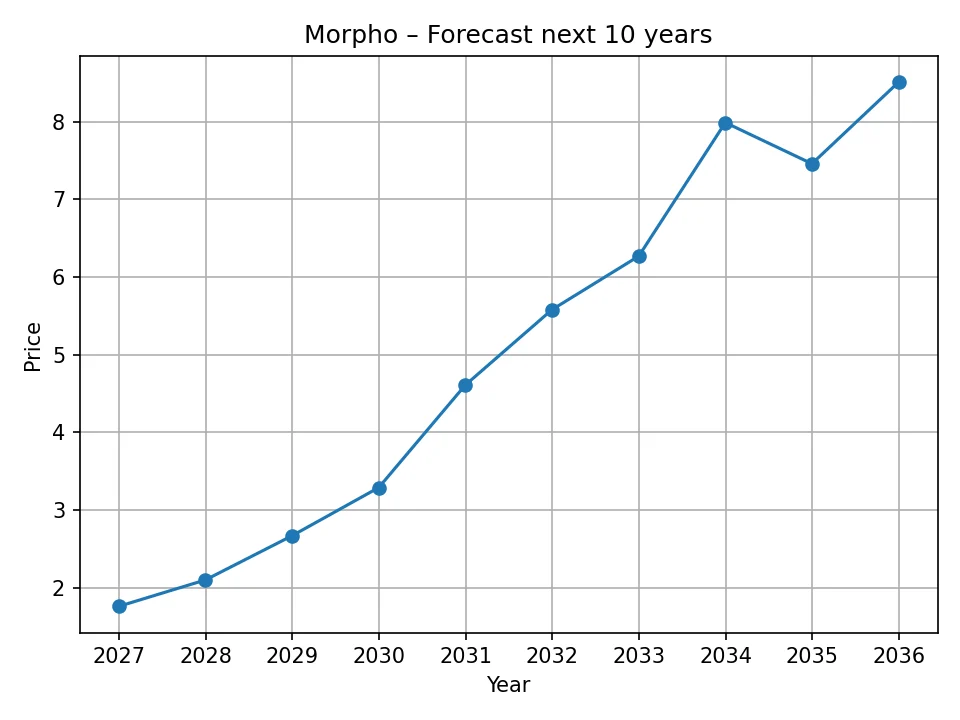

Morpho Price Forecast: Long-Term Outlook (10 Years)

Looking beyond the immediate future, a long-term price forecast for Morpho necessitates considering its potential to become a cornerstone of the decentralized financial system. The EchoPredict algorithm provides an optimistic outlook for Morpho over the next decade, suggesting substantial growth driven by continued innovation and broader market maturation.

Here is the annual forecast for Morpho from 2026 to 2035:

| Year | Projected Price (USD) |

|---|---|

| 2026 | $1.76 |

| 2027 | $2.10 |

| 2028 | $2.67 |

| 2029 | $3.29 |

| 2030 | $4.61 |

| 2031 | $5.58 |

| 2032 | $6.27 |

| 2033 | $7.99 |

| 2034 | $7.46 |

| 2035 | $8.51 |

The long-term forecast indicates a significant appreciation in Morpho’s value, projecting it to reach $8.51 by 2035. This suggests that the algorithm anticipates Morpho to solidify its position as a leading DeFi protocol, benefiting from the expanding adoption of decentralized finance and its unique approach to capital optimization. The steady, multi-year growth trajectory, particularly accelerating towards the latter half of the decade, implies that the model expects Morpho to overcome initial hurdles and achieve widespread recognition and utility.

For Morpho to realize these long-term projections, several critical developments would need to unfold. The continued success and expansion of Morpho Blue are paramount. If Morpho Blue becomes a preferred primitive for building new, specialized lending markets across various blockchain networks, its utility and the demand for its native token will naturally increase. Interoperability with other Layer 1 and Layer 2 solutions, strategic partnerships with major DeFi or traditional finance entities, and the ability to attract significant institutional capital could all serve as catalysts for this projected growth.

The long-term vision for Morpho likely includes its evolution into a highly liquid and fundamental infrastructure layer for lending and borrowing. As the DeFi space matures and potentially attracts billions or even trillions of dollars in TVL, a protocol that consistently offers superior rates and capital efficiency will be well-positioned to capture a substantial share of this market. The governance model also plays a crucial role; effective and forward-thinking decisions by the MORPHO token holders will be essential to navigate competitive pressures, regulatory changes, and technological advancements.

It’s important to acknowledge that long-term predictions in the crypto space are inherently speculative, given the rapid pace of technological change and market volatility. However, the projected growth for Morpho suggests a strong belief in its underlying technology, its ability to innovate, and its potential to remain relevant and competitive in the evolving decentralized financial landscape over the next decade.

Potential Growth Drivers and Future Outlook for Morpho

Morpho’s future growth hinges on its capacity to expand its footprint within the DeFi ecosystem and solidify its position as a go-to platform for capital-efficient lending. Several key growth drivers could fuel the predicted price appreciation:

1. Expansion of Morpho Blue Ecosystem

The modularity and permissionless nature of Morpho Blue represent a significant growth avenue. If developers and protocols increasingly adopt Morpho Blue as a building block for their lending markets, it would significantly increase Morpho’s TVL and transaction volume. This could include creating niche markets for specific asset pairs, enabling permissioned institutional lending, or developing new financial products on top of Morpho Blue’s infrastructure. The more protocols and users that build on or interact with Morpho Blue, the stronger its network effect will become.

2. Increased Adoption by Institutions and Retail Users

As DeFi gains mainstream acceptance, Morpho’s ability to offer optimized rates could attract a wider range of users, from large institutional investors seeking capital efficiency to retail users looking for better yields. Simplified user interfaces, robust security, and seamless integration with other financial tools will be critical for onboarding this broader audience. Compliance with potential future regulatory frameworks, if they become clearer, could also pave the way for greater institutional participation.

3. Cross-Chain Expansion

Currently, a significant portion of DeFi activity is concentrated on Ethereum. However, the multi-chain future of crypto is becoming increasingly apparent. Morpho’s strategic expansion to other high-throughput, low-cost blockchains (e.g., Layer 2 solutions, Solana, Avalanche, Polygon, etc.) could unlock vast new pools of liquidity and users. This would broaden its market reach and reduce reliance on a single ecosystem, mitigating potential risks associated with network congestion or high gas fees on Ethereum.

4. Innovations in Lending Mechanisms and Product Offerings

Beyond its core P2P matching, Morpho could introduce new features or lending models that further enhance capital efficiency or risk management. This might include novel collateral types, advanced liquidation mechanisms, or integrations with real-world assets (RWAs). The ability to adapt and innovate within the rapidly evolving DeFi landscape will be crucial for sustained relevance and growth.

5. Strategic Partnerships and Integrations

Collaborations with other prominent DeFi protocols, centralized exchanges, or traditional financial institutions could significantly boost Morpho’s visibility, liquidity, and user base. Partnerships that streamline access to Morpho’s optimized lending services or expand its utility within broader financial ecosystems would be highly beneficial.

6. Strong Community Governance and Development

The decentralized nature of Morpho, governed by its token holders, means that the community’s active participation and sound decision-making are vital. A vibrant and engaged community that drives progressive development, addresses challenges effectively, and promotes the protocol’s benefits will be a significant asset in its long-term growth.

These growth drivers, combined with a potentially maturing cryptocurrency market, could pave the way for Morpho to not only meet but potentially exceed the long-term price predictions, establishing itself as a fundamental and enduring component of the decentralized financial infrastructure.

Risks and Challenges for Morpho’s Price Trajectory

While the outlook for Morpho appears promising, it is imperative to acknowledge the inherent risks and challenges that could impact its price trajectory and long-term viability. The cryptocurrency market, and DeFi specifically, is characterized by high volatility, rapid technological change, and evolving regulatory landscapes. Understanding these risks is crucial for a balanced perspective.

1. Smart Contract Risk and Security Vulnerabilities

Despite rigorous audits, smart contracts are never entirely immune to vulnerabilities. An exploit or a major bug within Morpho’s protocol or any of its integrated underlying protocols (like Aave or Compound) could lead to significant loss of user funds, a severe blow to trust, and a sharp decline in the MORPHO token’s value. The immutability of Morpho Blue, while enhancing security, also means that once deployed, fixing certain issues would require new deployments, potentially fragmenting liquidity.

2. Regulatory Uncertainty and Intervention

Governments and financial regulators worldwide are increasingly scrutinizing the DeFi sector. Ambiguous or unfavorable regulations, such as those targeting decentralized lending platforms or specific collateral types, could severely restrict Morpho’s operations, limit its user base, or even declare certain activities illegal. This uncertainty is a major systemic risk for all DeFi protocols.

3. Competition and Market Saturation

The DeFi lending market is highly competitive. New protocols constantly emerge with innovative features, and existing ones continuously upgrade. Morpho must maintain its competitive edge by consistently offering superior rates, enhanced security, and new functionalities. Failure to innovate or a stronger competitor emerging could lead to market share erosion and reduced demand for the MORPHO token.

4. Liquidity and User Adoption Challenges

While Morpho aims to optimize capital, attracting and maintaining sufficient liquidity is an ongoing challenge. If users or large capital providers find more attractive opportunities elsewhere, or if there’s a general downturn in DeFi liquidity, it could hinder Morpho’s growth. Sustained user adoption is also dependent on ease of use, security, and consistent delivery of value.

5. Broader Market Downturns

As with all cryptocurrencies, Morpho’s price is highly correlated with the overall crypto market. A significant bear market, driven by macroeconomic factors, regulatory FUD (Fear, Uncertainty, Doubt), or a lack of institutional interest, could lead to widespread sell-offs, irrespective of Morpho’s individual performance or technological strengths.

6. Governance Risks

While decentralized governance is a strength, it also presents risks. Poorly thought-out governance proposals, a lack of participation from token holders, or the concentration of voting power could lead to decisions that negatively impact the protocol’s long-term health or security.

7. Oracle Failures and Price Manipulation

DeFi lending protocols rely on external price feeds (oracles) to determine collateral values and facilitate liquidations. An oracle malfunction or manipulation could lead to incorrect liquidations, financial losses for users, and a loss of trust in the protocol. Morpho’s robust oracle integration and reliance on reputable providers are crucial for mitigating this risk.

Navigating these challenges will require continuous innovation, robust security measures, adaptive strategy, and strong community engagement. While the long-term projections are optimistic, these risks serve as important caveats that investors should carefully consider.

Disclaimer: This article contains price predictions generated by the proprietary EchoPredict algorithm. It is important to note that cryptocurrency markets are highly volatile and unpredictable. Price forecasts are based on historical data and algorithmic analysis but do not guarantee future results. Investing in cryptocurrencies carries significant risk, and you could lose your entire investment. This article is for informational purposes only and does not constitute financial advice. We are not responsible for any investment decisions made based on the information provided herein.

Chris brings over six years of hands-on experience in cryptocurrency, bitcoin, business, and finance journalism. He’s known for clear, accurate reporting and insightful analysis that helps readers stay informed in fast-moving markets. When he’s off the clock, Chris enjoys researching emerging blockchain projects and mentoring new writers.