The realm of digital assets continues to captivate investors and innovators alike, with new projects emerging and existing ones evolving at a rapid pace. Among these, the cryptocurrency known as Four has garnered significant attention, showcasing a remarkable journey over the past year. As of today, its current price stands at 2.7234034538269043 USD, a testament to its dynamic performance within a fluctuating market. This comprehensive analysis delves into Four’s historical price trajectory, examines the multifaceted factors influencing its value, and presents an in-depth price forecast for both the short-term and the next decade, providing a robust framework for understanding its potential future.

Four, while a newly prominent name in the digital asset space, embodies the principles of decentralization and innovation that drive the broader cryptocurrency ecosystem. While the specifics of its underlying technology and use case may remain proprietary, its market performance suggests a project that is steadily building utility and attracting a growing community. It is often speculated that projects like Four aim to address critical challenges within blockchain technology, such as scalability, transaction efficiency, or cross-chain interoperability, thereby positioning themselves as foundational elements for the next generation of decentralized applications (dApps) and Web3 infrastructure. This ambition, coupled with strong development efforts and strategic partnerships, could be a key driver behind its observed market momentum and future growth potential. The project’s commitment to continuous improvement and adapting to market needs is often reflected in its price stability and upward trends, as investors recognize and reward tangible progress and a clear vision.

A Look Back: Four’s Historical Price Performance

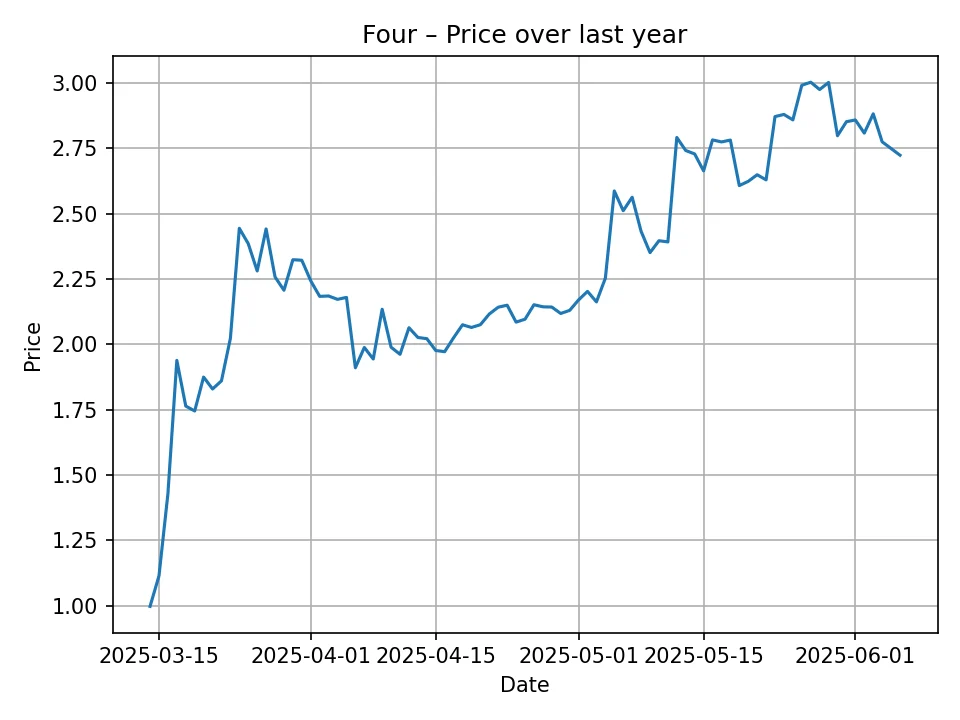

Analyzing the historical price data of Four over the past 12 months reveals a compelling narrative of growth and increasing investor confidence. Starting from a valuation around 0.997 USD approximately a year ago, Four has demonstrated significant upward momentum, culminating in its current price near 2.723 USD. This represents a substantial percentage gain, far exceeding the performance of many traditional assets and even outperforming several established cryptocurrencies during the same period.

The journey was not without its characteristic crypto volatility. We observed periods of rapid ascent, followed by corrections and consolidation phases. For instance, after an initial climb from below 1 USD to over 2 USD within its first few months, the price stabilized, showing strong support around the 1.9 USD to 2.2 USD range for an extended period. This consolidation indicates a healthy market, where early gains are digested, and a new, higher baseline is established, suggesting that the project is gaining fundamental strength rather than being driven purely by speculative fervor.

More recently, Four broke out of this consolidation pattern, pushing towards new all-time highs in the 2.7 USD to 3.0 USD range. The ability to maintain these elevated levels, even after reaching peak prices, speaks volumes about the sustained demand and renewed interest in the asset. The highest point recorded in the last year touched just over 3.00 USD, indicating the peak investor sentiment during this period. The current price of 2.723 USD, while slightly below its absolute peak, remains firmly within this higher trading range, illustrating resilience and a potentially strong foundation for future advancements. Such consistent growth, especially from a relatively lower base, often signals a maturing project that is successfully navigating market cycles and demonstrating its long-term viability to the investment community. This upward trend, marked by higher lows and higher highs, is a classic indicator of a bullish market structure, drawing in both retail and institutional capital.

Key Factors Influencing Cryptocurrency Prices

Understanding the future trajectory of Four, or any cryptocurrency, requires a deep dive into the myriad of factors that shape its market value. These influences can be broadly categorized into macroeconomic trends, crypto-specific dynamics, and project-centric developments.

Firstly, macroeconomic factors play an increasingly significant role. Global economic conditions, such as inflation rates, interest rate decisions by central banks, and geopolitical stability, directly impact investor appetite for risk assets like cryptocurrencies. When inflation is high, investors might seek refuge in assets perceived as inflation hedges, sometimes including cryptocurrencies, though this is not always the case. Conversely, rising interest rates can make traditional, less volatile investments more attractive, potentially drawing capital away from crypto markets. A strong global economy often correlates with increased liquidity and speculative investment, benefiting digital assets. Conversely, economic downturns or recessions can lead to de-risking across portfolios, causing sell-offs in volatile assets.

Secondly, broader cryptocurrency market dynamics are paramount. Bitcoin’s performance, often dubbed the “digital gold” of the crypto space, remains a dominant influence. A significant surge or drop in Bitcoin’s price typically creates ripple effects across the entire altcoin market, often leading to correlated movements. The overall market sentiment, driven by fear, uncertainty, and doubt (FUD) or by positive news and speculative excitement (FOMO), can trigger rapid price swings. Regulatory developments globally, whether supportive or restrictive, also have a profound impact. Favorable regulations can legitimize the industry and encourage institutional adoption, while punitive measures can stifle innovation and deter investment. Technological advancements in the wider blockchain ecosystem, such as upgrades to major networks or breakthroughs in scaling solutions, can also indirectly benefit projects like Four by improving the overall utility and perception of the space.

Finally, and perhaps most crucially for a specific project like Four, are its intrinsic characteristics and development milestones. The utility and real-world adoption of Four’s underlying technology are fundamental. If the project successfully solves a pain point or offers a compelling service that attracts a growing user base, its tokenomics will naturally support a higher valuation due to increased demand for its native token. A robust and clear development roadmap, consistently met milestones, and ongoing innovation demonstrate the team’s commitment and capability. Partnerships with established entities in various industries can significantly boost visibility, credibility, and adoption. The strength and experience of the development team and advisory board instill confidence. Furthermore, the community’s size, engagement, and decentralized governance mechanisms contribute to the network effect and long-term viability. Tokenomics, including supply mechanisms, vesting schedules, and staking opportunities, also play a vital role in determining long-term price stability and growth potential. A well-designed tokenomic model can create scarcity and incentivize holding, supporting price appreciation.

Methodology for Price Prediction: The EdgePredict Algorithm

Forecasting cryptocurrency prices is an inherently complex endeavor, given the market’s nascent nature, rapid technological evolution, and susceptibility to global events and sentiment. Unlike traditional financial markets, cryptocurrencies often exhibit higher volatility and are influenced by a unique set of factors. To navigate this complexity and provide data-driven insights, our projections for Four leverage an advanced, proprietary algorithmic model known as EdgePredict.

The EdgePredict algorithm is designed to analyze vast amounts of historical data, identifying intricate patterns and correlations that might escape conventional analysis. It incorporates a multi-layered approach, drawing insights from various dimensions of market behavior. Key inputs to the algorithm typically include, but are not limited to:

- Historical Price Data: Analyzing past price movements, trading volumes, and volatility metrics to identify trends, support and resistance levels, and cyclic patterns. This includes looking at daily, weekly, and monthly price candles to understand long-term and short-term market structure.

- Technical Indicators: Integration of numerous technical indicators such as Moving Averages, Relative Strength Index (RSI), MACD (Moving Average Convergence Divergence), Bollinger Bands, and other oscillators that provide signals about momentum, overbought/oversold conditions, and potential trend reversals.

- Market Sentiment Analysis: While not explicitly detailed, advanced algorithms often factor in sentiment from social media, news headlines, and broader market narratives. Changes in public perception and investor mood can significantly impact short-term price action, and the EdgePredict algorithm is engineered to detect these shifts.

- Volume and Liquidity Data: High trading volumes accompanying price movements often indicate stronger conviction behind a trend. Liquidity analysis helps understand how easily the asset can be bought or sold without significantly affecting its price, which is crucial for stability.

- Inter-asset Correlations: Recognizing how Four’s price moves in relation to benchmark cryptocurrencies like Bitcoin and Ethereum, as well as the broader altcoin market, can provide predictive insights into its future behavior within the ecosystem.

EdgePredict employs sophisticated machine learning techniques to process these inputs, dynamically adjusting its models to reflect evolving market conditions. It’s not a static formula but an adaptive system that learns from new data, allowing it to generate predictions with enhanced accuracy. However, it is crucial to understand that even the most advanced algorithms provide probabilistic forecasts, not certainties. The crypto market’s inherent unpredictability means that external, unforeseen events – such as sudden regulatory shifts, major security breaches, or unexpected technological breakthroughs – can always introduce deviations from predicted paths. The EdgePredict model aims to offer a robust, data-informed perspective, but it remains a projection based on the available data and recognized patterns.

Four (FOUR) Price Prediction: Monthly Outlook (2025-2026)

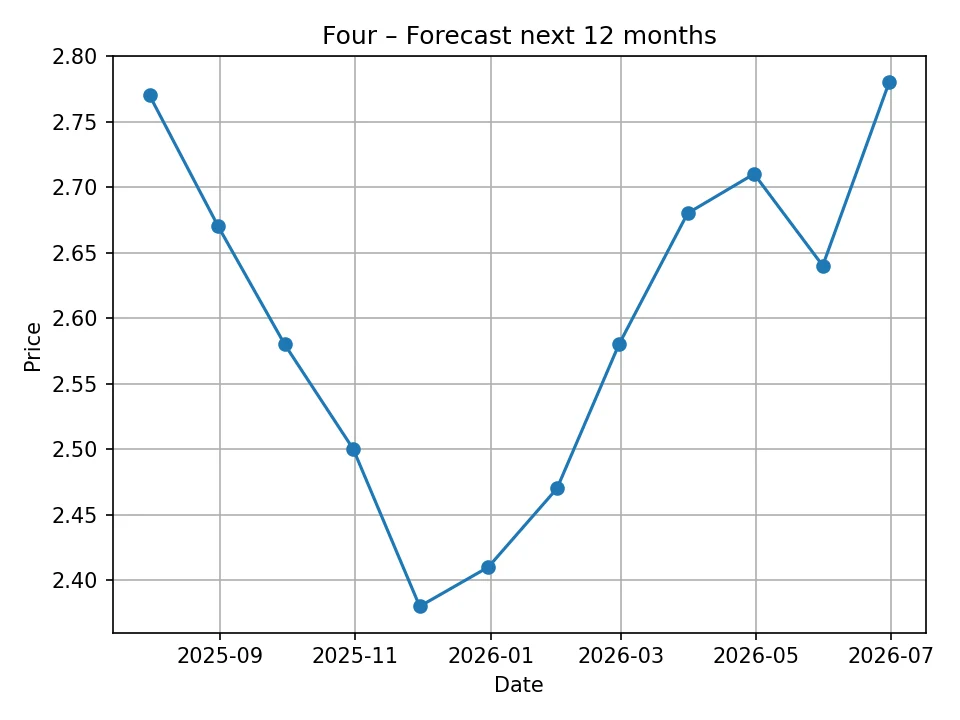

The short-term outlook for Four, spanning the next 12 months, suggests a period of potential consolidation followed by renewed upward momentum. Based on the EdgePredict algorithm’s analysis, the price of Four is projected to remain relatively stable in the immediate future, with minor fluctuations, before embarking on a gradual recovery and eventual growth.

Here is the monthly price forecast for Four from July 2025 to June 2026:

| Month/Year | Predicted Price (USD) |

|---|---|

| 2025-07 | 2.77 |

| 2025-08 | 2.67 |

| 2025-09 | 2.58 |

| 2025-10 | 2.50 |

| 2025-11 | 2.38 |

| 2025-12 | 2.41 |

| 2026-01 | 2.47 |

| 2026-02 | 2.58 |

| 2026-03 | 2.68 |

| 2026-04 | 2.71 |

| 2026-05 | 2.64 |

| 2026-06 | 2.78 |

The forecast indicates that after a slight uptick in July 2025 to 2.77 USD, Four might experience a moderate correction, gradually declining to around 2.38 USD by November 2025. This phase could be attributed to typical market consolidation after its recent gains, profit-taking by short-term traders, or general market seasonality often seen towards the end of the year. However, this projected dip is not significant enough to suggest a loss of fundamental strength; rather, it could represent a healthy retesting of support levels and accumulation opportunities for long-term investors.

Entering 2026, the algorithm projects a steady recovery. From January 2026, Four is anticipated to resume its upward trajectory, climbing from 2.47 USD in January to eventually reaching 2.78 USD by June 2026. This recovery suggests renewed buying interest and a positive market sentiment returning to the asset. The predicted price for June 2026, at 2.78 USD, is slightly higher than its current price of 2.72 USD, indicating that over the next year, Four is expected to maintain its value and potentially achieve modest gains, effectively negating the earlier projected dip. This short-term oscillation demonstrates the inherent volatility in crypto but also points to a fundamental resilience and a likely continuation of its growth narrative after a period of price discovery and stabilization. Factors that could support this recovery include continued development updates, increasing adoption of its platform, or favorable broader market conditions.

Four (FOUR) Price Prediction: Long-Term Outlook (2026-2035)

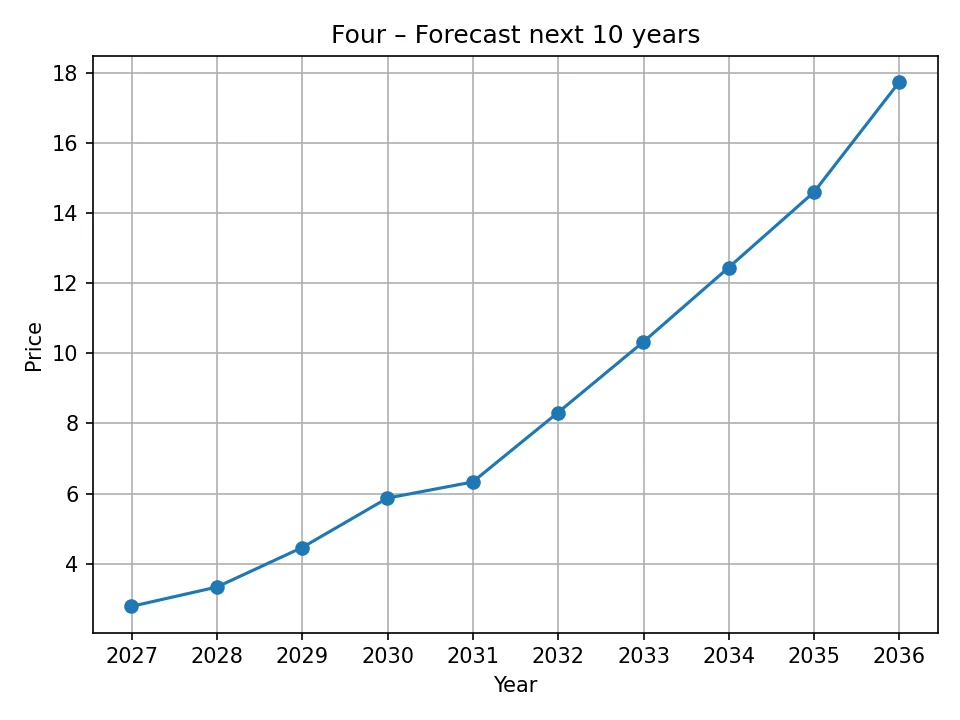

The long-term prognosis for Four, extending over the next decade, paints a distinctly bullish picture. The EdgePredict algorithm suggests that Four is poised for substantial, sustained growth, reflecting an optimistic outlook on its underlying technology, adoption potential, and the overall expansion of the decentralized digital economy.

Here is the yearly price forecast for Four from 2026 to 2035:

| Year | Predicted Price (USD) |

|---|---|

| 2026 | 2.78 |

| 2027 | 3.33 |

| 2028 | 4.46 |

| 2029 | 5.87 |

| 2030 | 6.33 |

| 2031 | 8.31 |

| 2032 | 10.33 |

| 2033 | 12.45 |

| 2034 | 14.60 |

| 2035 | 17.74 |

The long-term forecast illustrates an impressive compound annual growth rate. Starting from a projected 2.78 USD in 2026, Four is anticipated to gradually accelerate its ascent. By 2027, the price is expected to reach 3.33 USD, signifying a consistent upward trend. This growth becomes more pronounced in subsequent years, with projections indicating a price of 4.46 USD by 2028 and nearing 6 USD (specifically 5.87 USD) by 2029. Such increases suggest that Four is expected to firmly establish itself as a significant player within its niche, driven by continued technological advancements and expanding utility.

Looking further into the 2030s, the projections become even more compelling. The algorithm predicts that Four could surpass the 6 USD mark in 2030, reaching 6.33 USD, before experiencing a significant leap. By 2031, it is forecasted to hit 8.31 USD, and critically, cross the double-digit threshold, reaching 10.33 USD by 2032. This milestone would mark a substantial increase from its current valuation, underscoring the long-term potential identified by the EdgePredict model. The upward momentum is projected to continue, with Four potentially reaching 12.45 USD by 2033, 14.60 USD by 2034, and ultimately culminating at an impressive 17.74 USD by 2035.

This robust long-term growth forecast is likely predicated on several key assumptions: the continued maturation and mainstream adoption of blockchain technology, the successful execution of Four’s roadmap, the expansion of its ecosystem through strategic partnerships and integrations, and sustained demand for its specific utility within the burgeoning Web3 landscape. If Four can maintain its development velocity, attract a large and engaged user base, and innovate in its core offering, these long-term price targets could become attainable. The overall trend signifies a belief in Four’s intrinsic value proposition and its ability to thrive in an increasingly digital and decentralized world, transitioning from a nascent asset to a more mature and valuable component of the crypto economy.

Risks and Considerations for Investment in Four

While the price predictions for Four present an optimistic outlook, particularly in the long term, it is imperative for potential investors to recognize the inherent risks and uncertainties associated with cryptocurrency investments. The digital asset market is renowned for its volatility, and Four, like any other crypto, is not immune to rapid and unpredictable price swings.

One of the primary risks stems from market volatility and sentiment shifts. Cryptocurrency prices are highly sensitive to news, social media trends, and overall market sentiment, which can change direction swiftly. A sudden bearish turn in the broader crypto market, often led by Bitcoin’s performance, could trigger significant price corrections for Four, regardless of its individual fundamentals.

Regulatory uncertainty also poses a substantial risk. Governments and financial authorities worldwide are still grappling with how to regulate cryptocurrencies. New laws or restrictions, whether positive or negative, can have profound effects on market liquidity, investor confidence, and the operational viability of projects like Four. A lack of clear regulatory frameworks can deter institutional investment, while overly restrictive regulations could stifle innovation and adoption.

Competition within the blockchain space is fierce. Thousands of projects are vying for market share, user adoption, and developer talent. Even if Four has a strong initial value proposition, newer or more innovative solutions could emerge, challenging its dominance and impacting its long-term growth potential. Projects must continuously innovate and adapt to stay relevant.

Technological risks cannot be overlooked. Despite robust security measures, blockchain projects are always susceptible to potential vulnerabilities, hacks, or network failures. A significant security breach or a major bug in Four’s underlying code could lead to a loss of funds, reputational damage, and a severe drop in its market value. Furthermore, the rapid pace of technological change means that current solutions could become obsolete, necessitating constant upgrades and evolution.

Finally, liquidity risks, particularly for smaller market cap assets, can be a concern. While Four has seen significant growth, if trading volumes are low or concentrated on a few exchanges, large buy or sell orders could significantly impact its price, making it challenging for investors to enter or exit positions at desired prices.

Therefore, any investment decision regarding Four, or any cryptocurrency, should be made only after thorough personal research and due diligence. Investors should be prepared for the possibility of substantial losses and consider their risk tolerance carefully. The forecasts provided are based on algorithmic analysis of historical data and market patterns, but they do not account for unforeseen black swan events or sudden, drastic shifts in the global economic or regulatory landscape.

Conclusion

Four has demonstrated a remarkable journey over the past year, ascending from a modest valuation to a prominent position within the crypto landscape. Its historical performance reveals consistent growth, underscored by periods of consolidation that suggest increasing fundamental strength rather than fleeting speculative interest. The project’s current price stands as a testament to its market appeal and the ongoing development efforts of its team.

The comprehensive analysis, leveraging the sophisticated EdgePredict algorithm, points to a nuanced short-term outlook, with a period of potential consolidation before a gradual recovery. However, the long-term forecast paints a significantly bullish picture, projecting substantial and sustained growth for Four over the next decade. These projections are grounded in the assumption of continued innovation, expanding utility, increasing adoption within the broader Web3 ecosystem, and favorable market conditions.

While the future holds promising potential for Four to mature into a significant digital asset, investors are strongly advised to approach the cryptocurrency market with caution. The inherent volatility, evolving regulatory landscape, intense competition, and technological risks underscore the importance of personal research, understanding market dynamics, and acknowledging that all investments carry risk. The provided forecasts serve as a data-driven guide, reflecting the insights of an advanced predictive model, but they should not be construed as definitive financial advice.

Disclaimer: The price predictions and market analysis presented in this article are generated using a proprietary algorithmic forecasting model, EdgePredict, which analyzes historical data and identifies potential market trends. It is crucial to understand that these predictions are for informational purposes only and do not constitute financial advice. The cryptocurrency market is highly volatile and unpredictable. Investing in cryptocurrencies carries significant risks, and actual prices may differ materially from the forecasts. We are not responsible for any investment decisions made based on the information provided herein.

Chris brings over six years of hands-on experience in cryptocurrency, bitcoin, business, and finance journalism. He’s known for clear, accurate reporting and insightful analysis that helps readers stay informed in fast-moving markets. When he’s off the clock, Chris enjoys researching emerging blockchain projects and mentoring new writers.