The cryptocurrency market, known for its dynamic shifts and innovative breakthroughs, continues to captivate investors and technologists alike. Within this evolving landscape, the Theta Network stands out as a pioneering project focused on decentralized video delivery, artificial intelligence, and entertainment. As of early June 2025, the digital asset market remains a focal point of global financial discourse, with investors keenly analyzing various projects for their long-term potential and short-term movements. This comprehensive analysis delves into the Theta Network, exploring its fundamental technology, recent performance, key value drivers, and providing a detailed price forecast based on our proprietary analytical model.

Understanding the Theta Network: A Decentralized Vision for Media and AI

At its core, the Theta Network aims to revolutionize the traditional media and entertainment industry by leveraging blockchain technology. It proposes a decentralized infrastructure for video streaming, data delivery, and, increasingly, artificial intelligence computation. The network addresses critical issues prevalent in conventional content delivery systems, such as high streaming costs, poor video quality in remote regions, and a lack of transparency for content creators and viewers.

The Theta ecosystem operates on a unique dual-token model: THETA and Theta Fuel (TFuel). THETA is the governance token, primarily used for staking by validator and guardian nodes, ensuring network security and participating in protocol decisions. TFuel, on the other hand, acts as the operational token, serving as the “gas” for transactions on the Theta blockchain. It’s used for payments to relayers for sharing video streams, deploying smart contracts, and as rewards for users contributing their bandwidth and computing resources to the network.

Key components underpinning the Theta Network’s vision include the Theta blockchain itself, designed for high transaction throughput necessary for video streaming, and the Theta Edge Network. The Edge Network comprises thousands of community-run Edge Nodes that collaboratively relay video streams, store data, and perform distributed computing tasks. This decentralized network significantly reduces the costs associated with content delivery networks (CDNs) and enhances the quality and reliability of streaming, particularly for live events and high-definition content. Furthermore, Theta’s integration with AI is expanding, with the Edge Network poised to provide decentralized computing power for AI model training and inference, potentially democratizing access to powerful AI capabilities.

Recent Market Performance of Theta Network (THETA)

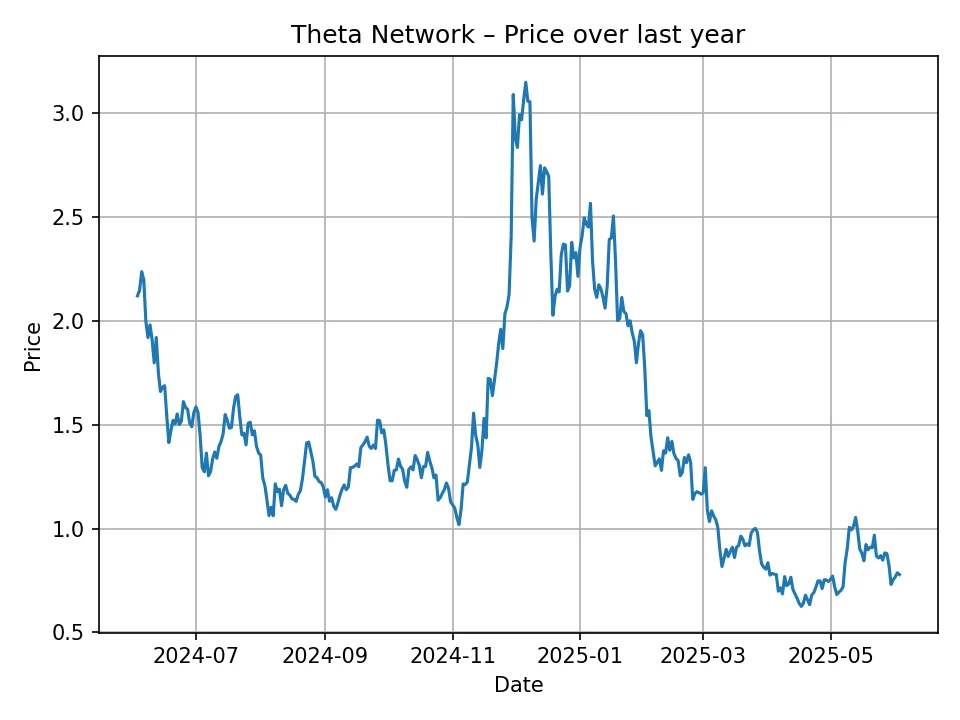

The cryptocurrency market has experienced significant volatility over the past year, and Theta (THETA) has been no exception. Analyzing the historical price data for THETA over the last 12 months reveals a journey marked by both consolidation and sharp movements, reflecting broader market sentiment and project-specific developments.

Over the past year, THETA’s price has oscillated considerably. From its higher points, nearing values above $3.00 USD in early 2024, it has seen corrections, dipping to lows around $0.62 USD during periods of market downturn or uncertainty. These fluctuations are typical for altcoins, which often amplify the movements of Bitcoin and Ethereum. The provided historical data indicates that THETA’s price has recently traded around $0.78 USD. This level represents a notable adjustment from its earlier highs, settling into a range that reflects current market conditions and investor assessments of its short-to-medium term potential.

Periods of significant price appreciation were often correlated with renewed interest in the broader crypto market, particularly during Bitcoin’s rallies, or specific announcements from the Theta team regarding partnerships, mainnet upgrades, or ecosystem growth. Conversely, downturns typically coincided with general market corrections, regulatory concerns, or periods of lower investor confidence in altcoins.

Key Drivers Influencing Theta’s Future Price

Several fundamental and technical factors are poised to influence the price trajectory of THETA in the coming years. Understanding these drivers is crucial for any potential investor.

Technological Advancements and Ecosystem Expansion

Theta Network’s commitment to continuous technological innovation is a primary price driver. The ongoing development and deployment of its core infrastructure are vital. The Theta Metachain, for instance, is a pivotal upgrade designed to enhance scalability, enable sovereign subchains, and foster greater interoperability within the Theta ecosystem. This framework allows various content creators, media companies, and developers to launch their own branded subchains, fostering a vast network of decentralized applications and services. The successful implementation and adoption of the Metachain are expected to significantly increase transaction volume and utility on the network, which could positively impact THETA and TFuel values.

The continued growth of the Theta Edge Network is also critical. As more users download and run Edge Nodes, the network’s capacity for decentralized video delivery and general-purpose computation expands. This distributed power is not only enhancing streaming quality but also positioning Theta to play a significant role in decentralized AI computation, offering an alternative to centralized cloud providers for training AI models. Any breakthroughs or widespread adoption in the decentralized AI sector, facilitated by Theta, would provide a strong bullish catalyst.

ThetaDrop NFT Marketplace remains a vital component, attracting major brands, content creators, and celebrities to mint and distribute NFTs. Successful NFT drops and continued engagement from prominent figures like Katy Perry or American Idol demonstrate the platform’s ability to onboard mainstream users and generate transaction fees (paid in TFuel), ultimately increasing the utility and demand for both tokens.

Strategic Partnerships and Institutional Adoption

Theta Network boasts an impressive list of enterprise validator nodes, including Google, Sony, Samsung, Binance, and other industry giants. These partnerships lend immense credibility and demonstrate a strong vote of confidence from established players. The more these enterprises integrate Theta’s technology into their existing operations or launch new ventures on the Theta blockchain, the greater the network’s adoption and perceived value. Future collaborations with leading media companies, sports leagues, or technology firms could trigger significant price surges due to increased utility and exposure.

Tokenomics and Utility

The dual-token economic model of THETA and TFuel is designed to create a self-sustaining ecosystem. The deflationary aspects of THETA, primarily through staking, reduce the circulating supply, while the utility of TFuel for network operations, payments, and rewards ensures constant demand. As the network scales and more applications are built, the demand for TFuel for gas fees will naturally increase. A portion of TFuel is also burned with each transaction, further contributing to its scarcity. These tokenomic mechanisms are fundamental to supporting long-term value for both assets.

Broader Cryptocurrency Market Trends

Like all cryptocurrencies, THETA’s price is heavily influenced by the overall market sentiment, particularly the performance of Bitcoin (BTC) and Ethereum (ETH). A sustained bull market for BTC often leads to an “altcoin season,” where capital flows from leading cryptocurrencies into smaller, high-potential projects like Theta. Conversely, bear markets or significant corrections in Bitcoin typically drag down the entire altcoin market. Macroeconomic factors, such as inflation rates, interest rate policies from central banks, and global regulatory developments, also play a crucial role in shaping investor risk appetite for volatile assets like cryptocurrencies.

Price Prediction Methodology: The Visionary Algorithm

Our price forecasts for Theta Network are generated using a proprietary analytical algorithm named “Visionary.” This algorithm utilizes a complex set of historical data, including price movements, trading volumes, and market cycles, alongside predictive models that account for potential future market dynamics. While the Visionary algorithm provides a data-driven outlook, it is important to remember that cryptocurrency markets are inherently unpredictable, and these forecasts should be considered speculative projections rather than financial advice.

Theta Price Prediction: The Next 12 Months (June 2025 – May 2026)

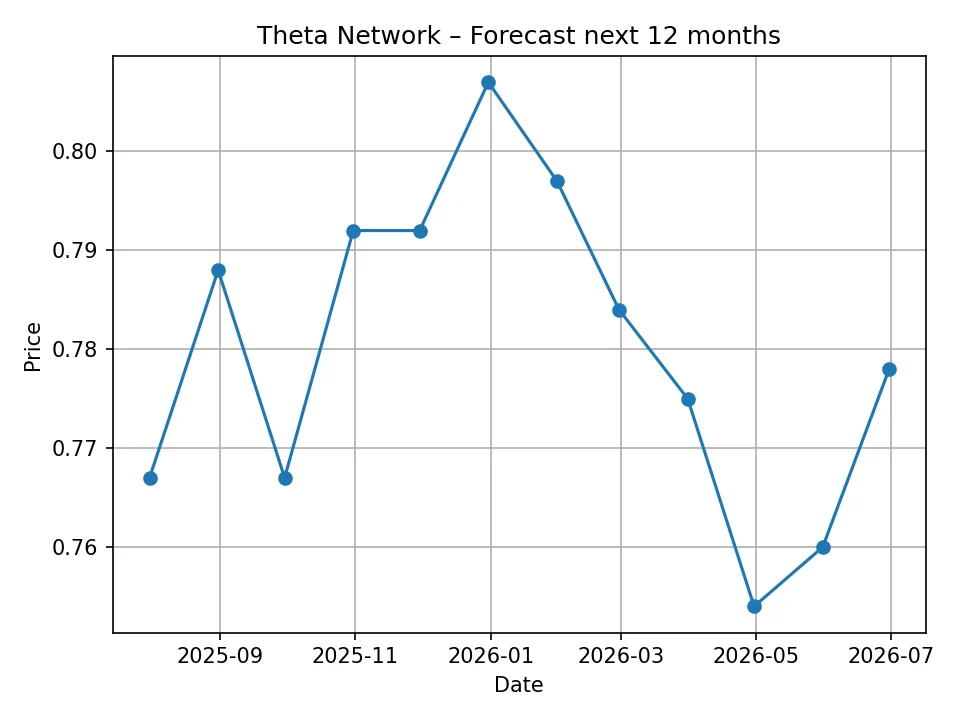

The short-term outlook for Theta Network, as predicted by the Visionary algorithm, suggests a period of relative stability with minor fluctuations. Investors looking at the immediate future might observe consolidation around the current trading levels, with potential for slight upward or downward movements depending on market catalysts.

Here is the detailed monthly price forecast for THETA in USD:

| Month/Year | Predicted Price (USD) |

|---|---|

| 2025-07 | 0.767 |

| 2025-08 | 0.788 |

| 2025-09 | 0.767 |

| 2025-10 | 0.792 |

| 2025-11 | 0.792 |

| 2025-12 | 0.807 |

| 2026-01 | 0.797 |

| 2026-02 | 0.784 |

| 2026-03 | 0.775 |

| 2026-04 | 0.754 |

| 2026-05 | 0.76 |

| 2026-06 | 0.778 |

The forecast suggests that THETA might trade within a narrow band, generally ranging from around $0.75 to $0.81 USD over the next year. This could indicate a period of accumulation or sideways movement as the market digests recent developments and anticipates future ecosystem growth. Short-term price action will likely be influenced by ongoing crypto market sentiment, news regarding Theta’s AI initiatives, or the launch of new enterprise partnerships.

Theta Price Prediction: The Next Decade (2026 – 2035)

Forecasting cryptocurrency prices over a decade is highly speculative, as numerous unforeseen technological, regulatory, and market shifts can occur. However, the Visionary algorithm provides a long-term trajectory based on extrapolated trends and foundational analysis.

Here is the detailed annual price forecast for THETA in USD:

| Year | Predicted Price (USD) |

|---|---|

| 2026 | 0.778 |

| 2027 | 0.809 |

| 2028 | 0.89 |

| 2029 | 0.794 |

| 2030 | 0.712 |

| 2031 | 0.684 |

| 2032 | 0.646 |

| 2033 | 0.688 |

| 2034 | 0.622 |

| 2035 | 0.695 |

The long-term forecast suggests an interesting trajectory. While the algorithm projects a modest increase for Theta in the immediate few years, peaking around $0.89 USD in 2028, it then indicates a gradual decline in price through the early 2030s, reaching a low of $0.622 USD in 2034 before a slight recovery towards $0.695 USD in 2035. This long-term outlook from the Visionary algorithm presents a cautious perspective, potentially factoring in challenges such as intense competition in decentralized media and AI, or a slower-than-expected adoption curve for its core technologies despite their innovative nature. It’s crucial for investors to consider that if Theta successfully achieves widespread adoption of its Metachain, significantly expands its AI capabilities, or secures transformative partnerships, its actual performance could deviate substantially from these projections, potentially achieving much higher values than predicted by this specific algorithm. This forecast underscores the importance of monitoring fundamental developments within the Theta ecosystem and broader market conditions.

Risks and Considerations for Investors

Investing in cryptocurrencies, including Theta Network, involves substantial risks. The market is notoriously volatile, and prices can swing dramatically within short periods. Potential investors should be aware of the following:

- Market Volatility: Cryptocurrency prices are subject to extreme fluctuations. Even well-established projects can experience significant drops.

- Regulatory Landscape: The regulatory environment for cryptocurrencies is still evolving globally. New regulations could impact Theta’s operations or market value.

- Competition: The decentralized streaming and AI computation sectors are becoming increasingly competitive, with new projects constantly emerging.

- Technological Risks: Despite its robust technology, Theta Network is not immune to potential technical glitches, security vulnerabilities, or challenges in scaling its infrastructure.

- Adoption Challenges: Widespread adoption of decentralized technologies can be slow, requiring significant user education and infrastructure development to overcome the network effects of traditional platforms.

It is paramount that individuals conduct their own thorough research and consider their financial situation and risk tolerance before making any investment decisions.

Conclusion

Theta Network presents a compelling vision for the future of decentralized media, entertainment, and AI. Its innovative technology, dual-token model, and strategic partnerships position it as a significant player in the blockchain space. While our Visionary algorithm suggests a relatively stable short-term outlook followed by a cautious long-term projection, the actual performance of THETA will ultimately hinge on the successful execution of its roadmap, continued ecosystem growth, and the broader trajectory of the cryptocurrency market.

As with any investment in the digital asset space, vigilance and comprehensive due diligence are crucial. The potential for disruption is immense, but so are the inherent risks.

Please note that this article is for informational purposes only and does not constitute financial advice. The price predictions presented are based on our proprietary analytical algorithm, named “Visionary,” and are inherently speculative. We are not responsible for any investment decisions made based on this information.

Chris brings over six years of hands-on experience in cryptocurrency, bitcoin, business, and finance journalism. He’s known for clear, accurate reporting and insightful analysis that helps readers stay informed in fast-moving markets. When he’s off the clock, Chris enjoys researching emerging blockchain projects and mentoring new writers.