In the dynamic and often unpredictable world of cryptocurrency, forecasting price movements is a complex endeavor, blending historical analysis with forward-looking projections based on technological advancements, market sentiment, and macroeconomic trends. Among the myriad digital assets vying for prominence, VeChain (VET) stands out with its distinct focus on real-world applications, particularly in supply chain management and sustainability. As of June 4, 2025, the cryptocurrency market continues to evolve rapidly, influencing the trajectory of assets like VET. This comprehensive article delves into the potential future price of VeChain, offering a detailed forecast for both the short and long term, underpinned by an analytical approach that considers various market indicators and the inherent characteristics of the VeChain ecosystem.

VeChain (VET) is more than just a digital currency; it is a blockchain platform designed to enhance supply chain management and business processes. Launched in 2015, VeChain aims to connect blockchain technology with the real world by providing solutions for tracking products, verifying authenticity, and ensuring data transparency across various industries. Its dual-token model, comprising VET for value transfer and smart contract execution, and VeThor (VTHO) for transaction costs, is a crucial component of its economic design, providing stability and predictability for enterprise adoption. VeChain’s commitment to solving tangible business problems, evidenced by its partnerships with major corporations, positions it uniquely within the blockchain landscape. The platform’s emphasis on verifiable data and secure information flow makes it particularly attractive for sectors requiring high levels of trust and traceability, such as logistics, luxury goods, food safety, and even carbon management.

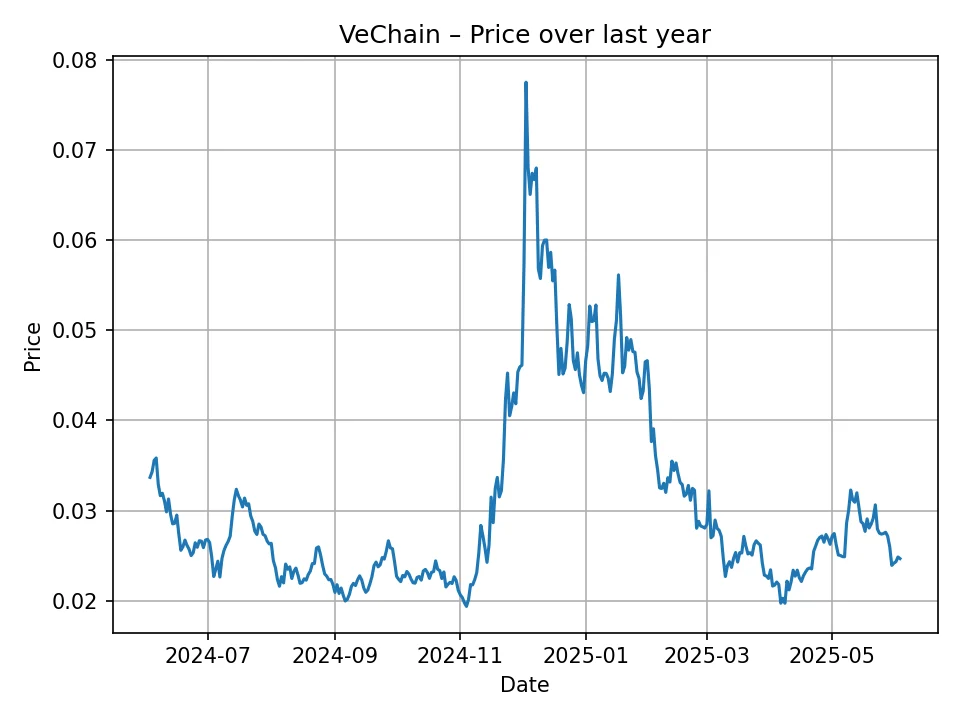

VeChain’s Historical Performance: A Retrospective

To understand potential future movements, examining VeChain’s recent historical performance is crucial. Over the past 12 months, VeChain (VET) has experienced a range of price fluctuations, reflecting the broader volatility inherent in the cryptocurrency market while also showcasing its unique response to internal developments and external pressures. Starting from approximately $0.0337 USD a year ago, VET saw a period of decline, dipping to lows around $0.0194 USD. This downward trend, observed in various cryptocurrencies, often correlates with broader market corrections or periods of macroeconomic uncertainty. However, VET also demonstrated resilience and significant recovery phases. Notably, there was a strong rally that pushed its price to highs of around $0.0775 USD, showcasing its potential for substantial upward movement when market conditions are favorable and positive sentiment prevails. This peak was followed by a correction, with the price settling back into a range around the $0.0247 USD mark as of the most recent historical data point. This historical overview indicates that while VET is subject to market-wide volatility, it also possesses the capacity for strong growth, often driven by specific news, partnership announcements, or a renewed investor interest in real-world blockchain utility.

Key Factors Influencing VeChain’s Price Trajectory

The future price of VeChain, like any cryptocurrency, is influenced by a confluence of intricate factors. Understanding these elements is fundamental to any credible price prediction:

- Broader Cryptocurrency Market Trends: Bitcoin’s performance often sets the tone for the altcoin market. A bullish Bitcoin market typically creates a rising tide that lifts most other cryptocurrencies, including VET. Conversely, a Bitcoin correction can lead to widespread declines.

- VeChain Ecosystem Development: The continuous advancement of the VeChainThor blockchain, including protocol upgrades, increased transaction throughput, and enhanced smart contract functionalities, directly impacts its utility and, consequently, its value. The adoption of new technologies or features, such as improved cross-chain interoperability or new developer tools, can significantly boost investor confidence.

- Enterprise Adoption and Partnerships: VeChain’s core strength lies in its ability to facilitate real-world enterprise solutions. New partnerships with global companies, expansion into new industries (e.g., healthcare, energy, luxury goods, food and beverage), and the successful implementation of its solutions for existing clients are critical drivers of demand for VET. Each successful deployment validates VeChain’s value proposition and attracts further interest.

- Regulatory Landscape: The evolving global regulatory environment for cryptocurrencies can have a profound impact. Clear and supportive regulations can foster institutional investment and mainstream adoption, whereas stringent or ambiguous regulations might hinder growth. VeChain’s focus on compliance and enterprise-grade solutions may offer it an advantage in navigating these waters.

- Macroeconomic Conditions: Global economic factors such as inflation rates, interest rate decisions by central banks, and geopolitical stability can influence investor appetite for risk assets like cryptocurrencies. During periods of economic uncertainty, investors might move towards more traditional safe-haven assets, affecting crypto prices.

- Community Growth and Developer Activity: A vibrant and engaged community, coupled with active developer contributions to the VeChainThor ecosystem, signals a healthy and sustainable project. Increased DApp development, token listings on new exchanges, and active social media presence can contribute to VET’s visibility and liquidity.

- Competitive Landscape: The blockchain space is highly competitive. VeChain must continually innovate and demonstrate its superior value proposition to maintain its edge against other platforms offering similar enterprise-focused solutions.

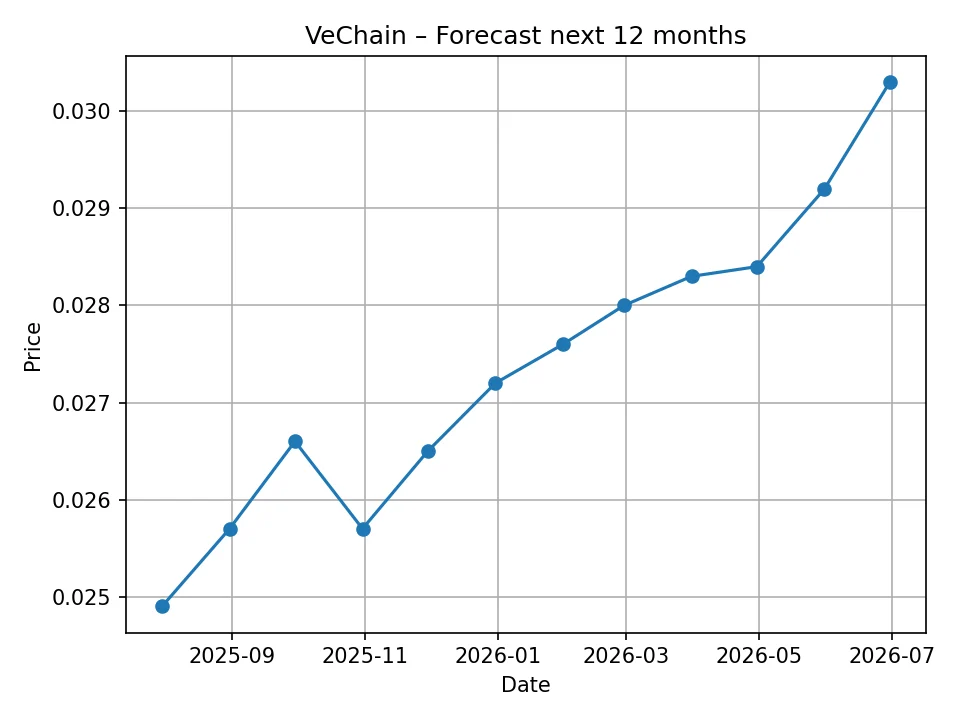

Short-Term VeChain Price Prediction (12 Months)

Based on our proprietary “Visionary” algorithm, the short-term outlook for VeChain suggests a period of steady, gradual growth over the next 12 months. This projection considers recent market dynamics, VeChain’s intrinsic utility, and anticipated developments within its ecosystem.

The forecast indicates that VET’s price, starting from approximately $0.0249 USD in July 2025, is expected to experience consistent upward momentum. While no dramatic surges are predicted in this immediate period, the algorithm points to a healthy and sustainable increase, potentially reflecting increasing adoption rates and growing confidence in VeChain’s enterprise solutions. This steady climb suggests a market that is consolidating previous gains and preparing for future expansion, driven by continuous integration into global supply chains and sustainability initiatives.

Here is a detailed monthly breakdown of the VeChain (VET) price prediction:

| Month/Year | Predicted Price (USD) |

|---|---|

| July 2025 | $0.0249 |

| August 2025 | $0.0257 |

| September 2025 | $0.0266 |

| October 2025 | $0.0257 |

| November 2025 | $0.0265 |

| December 2025 | $0.0272 |

| January 2026 | $0.0276 |

| February 2026 | $0.0280 |

| March 2026 | $0.0283 |

| April 2026 | $0.0284 |

| May 2026 | $0.0292 |

| June 2026 | $0.0303 |

By June 2026, the predicted price is around $0.0303 USD, representing a modest but positive trajectory. This short-term stability, if realized, could build a strong foundation for more significant growth in the subsequent years, as VeChain continues to mature and expand its influence.

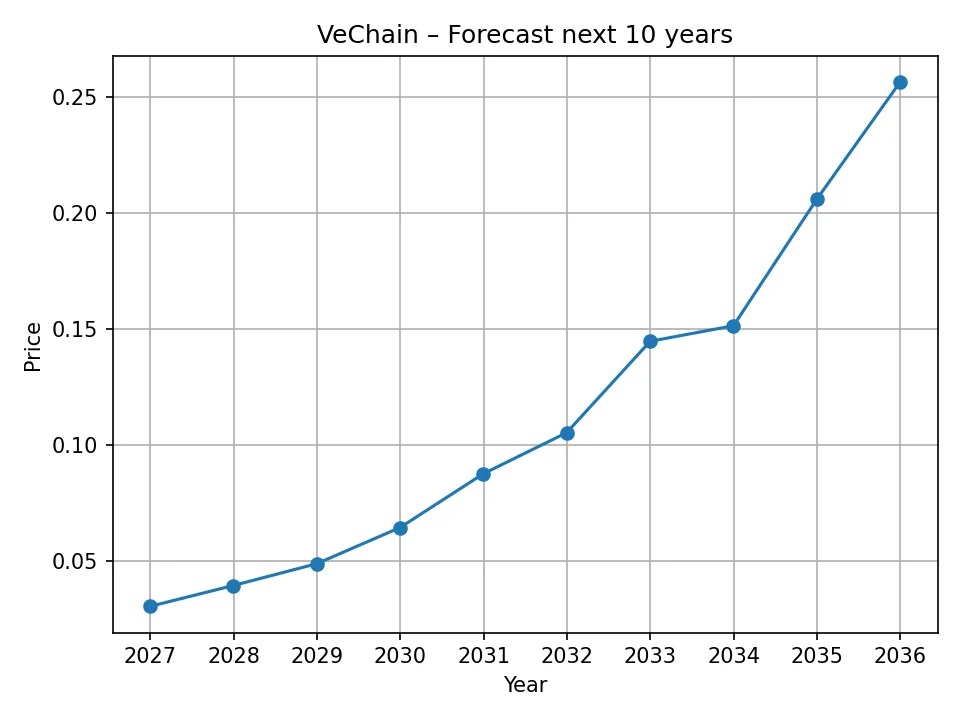

Long-Term VeChain Price Prediction (10 Years)

Looking further into the future, the long-term price prediction for VeChain presents a significantly more bullish outlook, reflecting the potential for widespread adoption of blockchain technology in real-world industries and VeChain’s established position within this niche. Our “Visionary” algorithm projects substantial growth over the next decade, with VeChain’s utility gaining increasing recognition and demand.

The annual forecast suggests a steady and accelerating appreciation in VET’s value. From an estimated $0.0303 USD at the end of 2026, the price is projected to reach approximately $0.2563 USD by the end of 2035. This long-term trajectory is predicated on several key assumptions, including continued technological innovation, increasing enterprise integration, favorable regulatory environments, and a growing understanding of the benefits of blockchain for supply chain and sustainability solutions on a global scale. As more industries realize the imperative for transparency, traceability, and efficiency, platforms like VeChain are poised to capture significant market share.

Here is a detailed annual breakdown of the VeChain (VET) price prediction:

| Year | Predicted Price (USD) |

|---|---|

| 2026 | $0.0303 |

| 2027 | $0.0393 |

| 2028 | $0.0487 |

| 2029 | $0.0643 |

| 2030 | $0.0875 |

| 2031 | $0.1052 |

| 2032 | $0.1446 |

| 2033 | $0.1513 |

| 2034 | $0.2058 |

| 2035 | $0.2563 |

Driving Factors for Long-Term Growth

The optimistic long-term forecast for VeChain hinges on several crucial drivers:

- Continued Enterprise Adoption: As businesses increasingly recognize the efficiency, transparency, and cost-saving benefits of blockchain, VeChain’s proven solutions are likely to be adopted by a wider array of global enterprises. Its focus on compliance and ease of integration appeals directly to large corporations.

- Scalability and Network Stability: Ongoing improvements to the VeChainThor blockchain’s scalability and stability will be paramount for handling increased transaction volumes from enterprise clients. A robust and reliable network is essential for large-scale commercial use.

- Emergence of New Use Cases: Beyond traditional supply chain, VeChain is exploring new frontiers like carbon footprint tracking, digital identity, and NFTs with real-world utility. Expansion into these burgeoning sectors could open up vast new markets for VET.

- Regulatory Clarity and Institutional Investment: As regulatory frameworks for cryptocurrencies become clearer and more favorable globally, institutional investors are likely to enter the market with greater confidence, channeling significant capital into well-established and utility-focused projects like VeChain.

- Technological Innovation: VeChain’s commitment to continuous innovation, including advancements in IoT integration, data management, and interoperability with other blockchain networks, will ensure its relevance and competitiveness in a rapidly evolving tech landscape.

- Global Macroeconomic Trends: A general shift towards digital economies and a greater emphasis on verifiable, transparent data will naturally benefit blockchain solutions. As the global economy increasingly demands these features, VeChain stands to gain.

Potential Challenges and Risks

While the outlook for VeChain appears promising, it is crucial to acknowledge the inherent challenges and risks that could impact its price trajectory:

- Intense Competition: The blockchain space is highly competitive, with numerous platforms vying for enterprise adoption. VeChain faces competition from other established blockchains and emerging technologies that could offer similar or superior solutions.

- Regulatory Uncertainty: Despite progress, regulatory clarity remains a global challenge for the crypto industry. Sudden adverse regulatory changes in key markets could negatively impact VeChain’s operations and adoption.

- Technological Obsolescence: The rapid pace of technological change means that even advanced platforms must continuously innovate to avoid becoming obsolete. Failure to adapt to new industry standards or develop cutting-edge solutions could hinder growth.

- Market Volatility: Cryptocurrencies are known for their high volatility. External shocks, such as a significant downturn in the broader crypto market or major global economic crises, could lead to sharp price declines for VET, irrespective of its fundamental strengths.

- Adoption Hurdles: While VeChain has secured notable partnerships, the pace of widespread enterprise adoption of blockchain solutions can be slow due to integration complexities, resistance to change, or high initial costs for businesses.

In conclusion, VeChain (VET) holds a unique position in the cryptocurrency market, driven by its practical applications in real-world industries, particularly supply chain management and sustainability. Its historical performance demonstrates resilience and periods of significant growth, albeit within a volatile market. The short-term forecast suggests a steady, gradual increase, building a stable foundation. The long-term projection, extending to 2035, paints a much more optimistic picture, anticipating substantial appreciation as blockchain technology becomes increasingly integrated into global business processes. This bullish long-term outlook is supported by VeChain’s ongoing innovation, potential for broader enterprise adoption, and favorable shifts in the regulatory landscape. However, it is imperative for potential investors to consider the inherent risks, including market volatility, competitive pressures, and regulatory uncertainties. Navigating the future of VeChain, like any cryptocurrency, requires a thorough understanding of these dynamics and a cautious approach.

Disclaimer: The price predictions provided in this article are based on analysis using a proprietary algorithm and historical data. These forecasts are for informational purposes only and should not be considered financial advice. The cryptocurrency market is highly volatile, and actual prices may vary significantly from the predictions. Investing in cryptocurrencies carries inherent risks, and individuals should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions. We are not responsible for any investment losses that may arise from reliance on these predictions.

Chris brings over six years of hands-on experience in cryptocurrency, bitcoin, business, and finance journalism. He’s known for clear, accurate reporting and insightful analysis that helps readers stay informed in fast-moving markets. When he’s off the clock, Chris enjoys researching emerging blockchain projects and mentoring new writers.