The realm of decentralized finance (DeFi) continues to evolve at a rapid pace, with liquid staking emerging as a cornerstone innovation. Among the pioneers in this space, Lido DAO (LDO) stands out, offering a solution to the illiquidity challenge associated with staked cryptocurrencies. As of early June 2025, investors and enthusiasts are keenly observing LDO’s price movements, eager to understand its future trajectory. This article delves into the historical performance of Lido DAO, examines the multifaceted factors influencing its valuation, and presents price predictions for both the short-term (12 months) and long-term (10 years), generated by the NovaCast algorithm.

Understanding Lido DAO (LDO)

Lido DAO is a decentralized autonomous organization that provides liquid staking services for various proof-of-stake (PoS) cryptocurrencies, most notably Ethereum (ETH), but also Solana (SOL), Polygon (MATIC), and others. Its core innovation lies in allowing users to stake their assets while still maintaining liquidity. When users stake their ETH with Lido, for instance, they receive stETH (staked Ethereum) in return. This stETH token represents their staked ETH and accumulated staking rewards, and crucially, it can be freely traded, used in other DeFi protocols, or leveraged as collateral. This addresses a major drawback of traditional staking, where assets are locked and inaccessible.

The native token of the Lido protocol is LDO. LDO is a governance token, meaning its holders can vote on critical decisions regarding the protocol’s development, parameters, upgrades, and treasury management. This decentralized governance model is central to Lido’s ethos, empowering its community to shape its future. The value proposition of Lido DAO is clear: it democratizes access to staking rewards, enhances capital efficiency in DeFi, and contributes to the overall security and decentralization of PoS networks.

Lido DAO’s Historical Price Performance (Last 12 Months)

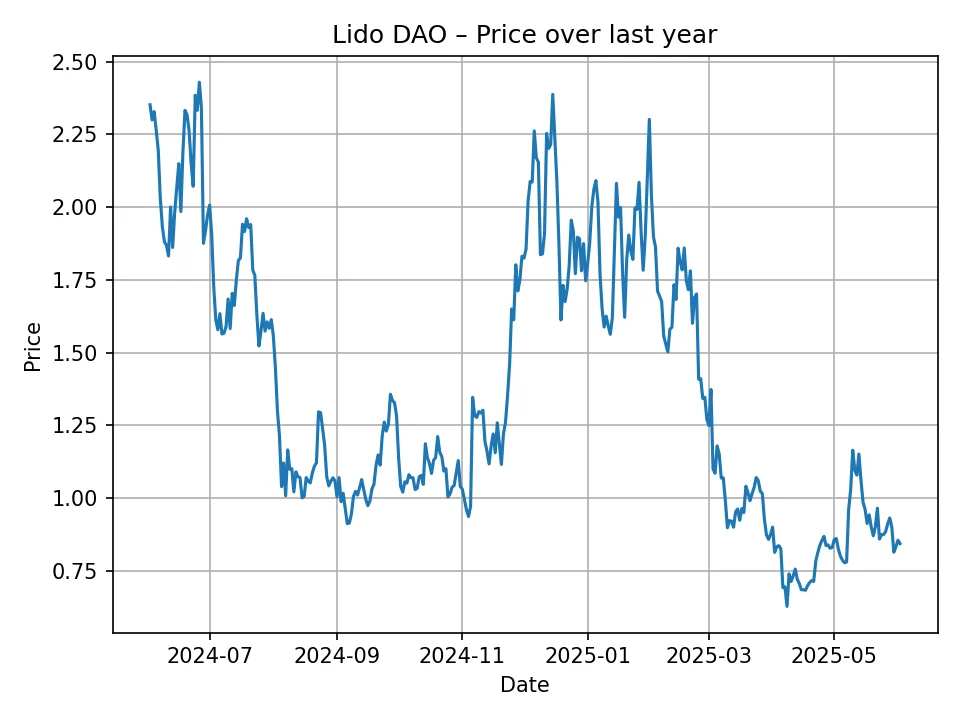

Analyzing the historical price data for Lido DAO over the past 12 months provides crucial context for understanding its volatility and underlying trends. The period between June 2024 and June 2025 has been characterized by significant fluctuations, reflective of the broader cryptocurrency market’s dynamics and specific developments within the liquid staking sector.

The provided historical data shows LDO experiencing periods of both consolidation and sharp decline, with occasional spikes. At the start of this 12-month period, around early June 2024, LDO was trading around the $2.35 USD mark. It experienced a notable dip towards the end of June 2024, falling below $2.00, and further decreased in July, hitting lows around $1.00 – $1.20 USD. This period likely coincided with broader market corrections or profit-taking after earlier rallies.

Throughout the latter half of 2024, LDO continued to exhibit volatility. While there were attempts at recovery, with prices reaching back into the $1.30 – $1.40 USD range at times, the overall trend leaned downwards. The cryptocurrency market, in general, saw periods of consolidation and uncertainty during this time, which undoubtedly impacted LDO. The lowest point observed in the provided data appears to be around $0.627 USD, recorded in May 2025, which represents a significant drawdown from its June 2024 highs.

Towards the end of the 12-month period, leading up to early June 2025, the price hovered around $0.84 USD. This suggests that Lido DAO has been navigating a challenging market environment, with its price reacting to both macro crypto trends and micro-level changes in its own ecosystem or competition. The high degree of volatility underscores the speculative nature of cryptocurrency investments, even for established projects like Lido.

Key Factors Influencing Lido DAO’s Price

The future price of Lido DAO, like any other cryptocurrency, is subject to a complex interplay of various factors. Understanding these elements is essential for a comprehensive price forecast.

- Broader Cryptocurrency Market Trends: The performance of Bitcoin (BTC) and Ethereum (ETH) heavily influences altcoins like LDO. A bullish trend in the overall market, often driven by institutional adoption, technological advancements, or positive regulatory news, typically pulls LDO prices upwards. Conversely, bear markets or significant corrections in major cryptocurrencies can lead to LDO depreciation.

- Ethereum’s Staking Evolution: As the leading liquid staking protocol for Ethereum, Lido’s success is intricately linked to the continued growth and stability of Ethereum’s proof-of-stake network. Factors such as the number of ETH staked, the average staking yield, and the overall security of the network directly impact Lido’s perceived value and the demand for its services.

- Competition in Liquid Staking: The liquid staking landscape is becoming increasingly competitive, with new protocols and existing players vying for market share. Innovations from competitors, new features, or lower fees offered by rivals could impact Lido’s dominance and, consequently, the demand for its LDO token.

- Regulatory Landscape: Governments worldwide are increasingly scrutinizing the cryptocurrency sector. Potential regulations concerning staking services, DeFi protocols, or even the classification of tokens like LDO could have a profound impact on its price. Favorable regulations could foster growth, while restrictive measures could hinder it.

- Protocol Development and Security: Continuous development, successful implementation of new features, and robust security audits are vital for maintaining user trust and attracting more stakers to Lido. Any security breaches or significant technical issues could severely damage its reputation and price.

- DAO Governance and Community Engagement: The strength and effectiveness of the Lido DAO in making crucial decisions, managing its treasury, and fostering a vibrant community play a role in its long-term viability. Sound governance can instill confidence, while internal disputes or inefficiencies could deter investors.

- Macroeconomic Environment: Global economic conditions, such as inflation rates, interest rate policies by central banks, and geopolitical events, can influence investor sentiment towards risk assets like cryptocurrencies. During periods of economic uncertainty, investors may shy away from volatile assets, impacting LDO’s price.

Lido DAO Monthly Price Prediction (July 2025 – June 2026)

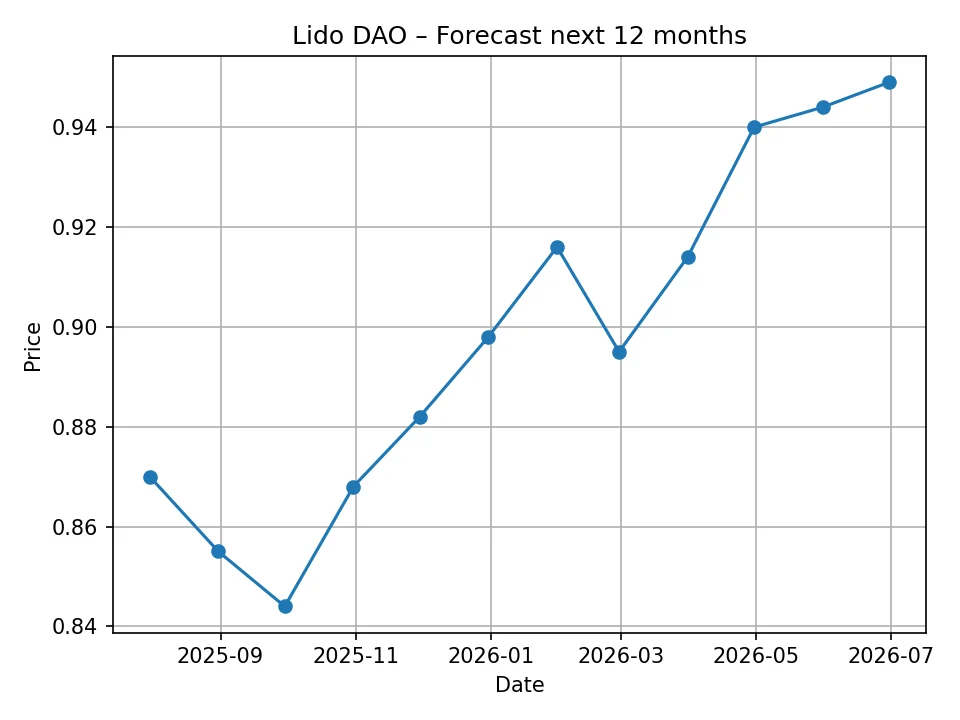

The NovaCast algorithm provides a detailed monthly price prediction for Lido DAO, offering insights into its near-term trajectory. Based on the analysis of historical data and market dynamics, the algorithm projects a period of stabilization and modest growth for LDO in the coming 12 months.

The prediction suggests that LDO, currently around $0.84 USD, may experience slight fluctuations but generally trend upwards, albeit gradually. This period could be characterized by consolidation as the market digests recent movements and potential new developments within the DeFi and liquid staking sectors.

Here is the detailed monthly price prediction for LDO:

| Month | Price (USD) |

|---|---|

| 2025-07 | 0.87 |

| 2025-08 | 0.855 |

| 2025-09 | 0.844 |

| 2025-10 | 0.868 |

| 2025-11 | 0.882 |

| 2025-12 | 0.898 |

| 2026-01 | 0.916 |

| 2026-02 | 0.895 |

| 2026-03 | 0.914 |

| 2026-04 | 0.94 |

| 2026-05 | 0.944 |

| 2026-06 | 0.949 |

As per the NovaCast projection, Lido DAO is expected to maintain a price generally below $1.00 USD for the entire 12-month period, ending June 2026 at approximately $0.949 USD. This indicates a cautious but positive outlook, suggesting that while explosive growth might not be imminent, a foundational recovery could be underway.

Lido DAO Annual Price Prediction (2026 – 2035)

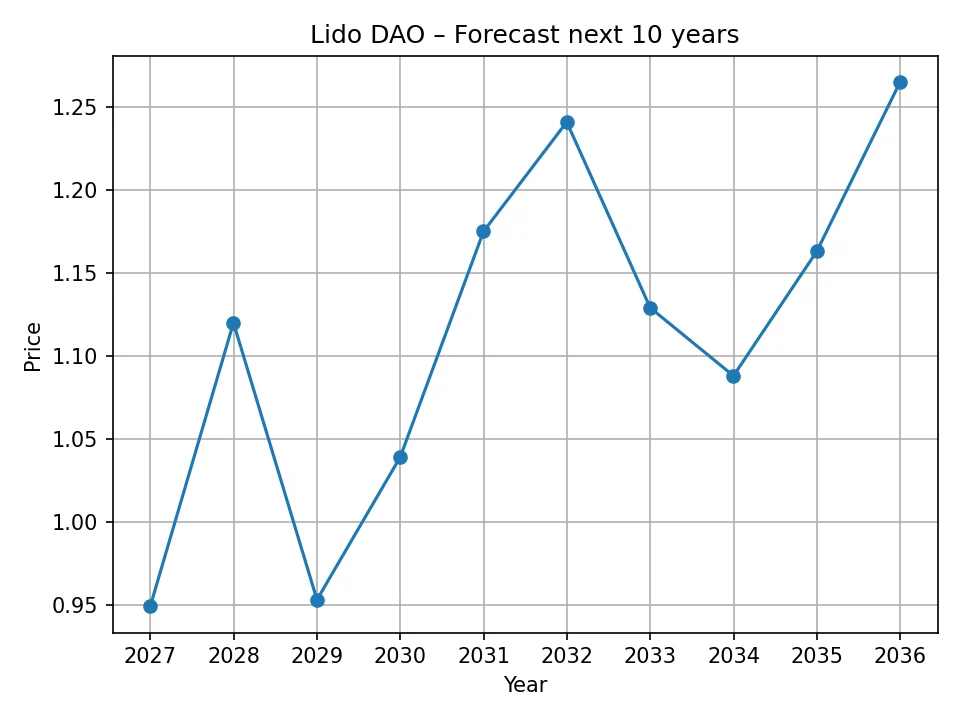

Extending the forecast further, the NovaCast algorithm provides a 10-year annual price prediction for Lido DAO, offering a glimpse into its potential long-term valuation. This long-term outlook is crucial for investors considering LDO as a strategic holding within their diversified portfolios.

The annual predictions indicate a generally upward trend over the decade, albeit with expected periods of volatility and potential corrections, which are inherent in the crypto market. The algorithm foresees Lido DAO gradually building on its fundamental strengths and potentially benefiting from the maturation of the DeFi and liquid staking ecosystems.

Here is the detailed annual price prediction for LDO:

| Year | Price (USD) |

|---|---|

| 2026 | 0.949 |

| 2027 | 1.12 |

| 2028 | 0.953 |

| 2029 | 1.039 |

| 2030 | 1.175 |

| 2031 | 1.241 |

| 2032 | 1.129 |

| 2033 | 1.088 |

| 2034 | 1.163 |

| 2035 | 1.265 |

The long-term forecast suggests that by 2035, Lido DAO could reach a price of approximately $1.265 USD. This projection indicates sustained, albeit moderate, growth over the decade. Notably, there is a predicted dip in 2028 and 2033, which could reflect anticipated market cycles or periods of heightened competition/regulatory pressure. However, the overall trend remains positive, indicating confidence in Lido’s continued relevance and adoption within the liquid staking domain.

Considerations for Investors

While price predictions offer valuable insights, it is paramount for investors to approach the cryptocurrency market with a clear understanding of its inherent risks and volatility.

- Market Volatility: Cryptocurrency prices are notoriously volatile and can change rapidly due to various unforeseen events.

- Fundamental Analysis: Beyond price predictions, it is crucial to conduct thorough due diligence on Lido DAO’s technology, team, partnerships, and competitive advantages.

- Risk Management: Investors should never invest more than they can afford to lose and consider diversifying their portfolios to mitigate risks.

- Long-Term Vision: For projects with strong fundamentals like Lido, a long-term investment horizon may be more suitable to ride out short-term market fluctuations.

Conclusion

Lido DAO remains a pivotal player in the liquid staking sector, offering a critical service that bridges the gap between staking rewards and asset liquidity. Its historical performance reflects the broader crypto market’s challenges, yet its fundamental utility continues to underscore its potential. The NovaCast algorithm projects a cautious but positive outlook for LDO, suggesting a period of stabilization and modest recovery in the short term, followed by gradual long-term growth with intermittent corrections. As the DeFi landscape matures and proof-of-stake networks continue to expand, Lido DAO’s role is likely to remain significant, influencing its future price trajectory.

Disclaimer: This article contains price predictions generated by the proprietary NovaCast algorithm and is intended for informational purposes only. It does not constitute financial advice. Cryptocurrency markets are highly volatile, and actual prices may vary significantly from the predictions. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions. We are not responsible for any investment outcomes based on the information provided herein.

Chris brings over six years of hands-on experience in cryptocurrency, bitcoin, business, and finance journalism. He’s known for clear, accurate reporting and insightful analysis that helps readers stay informed in fast-moving markets. When he’s off the clock, Chris enjoys researching emerging blockchain projects and mentoring new writers.